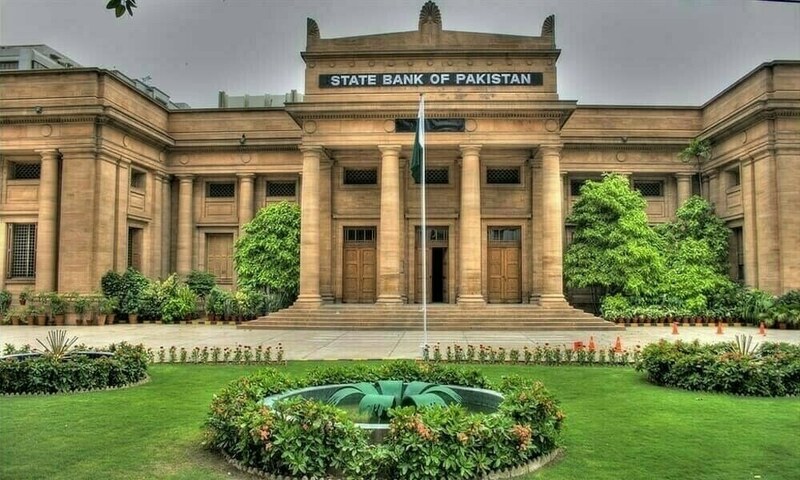

The State Bank of Pakistan (SBP) stepped in on Monday to alleviate liquidity strains in the banking sector by injecting a total of Rs 316 billion through conventional and Shariah-compliant Open Market Operations (OMO).

Details reveal that Rs238 billion were infused via a conventional four-day reverse repo OMO, accepted at an interest rate of 11.07 percent. Additionally, Rs78 billion were allocated through a Shariah-compliant Modarabah-based OMO, with an accepted rate of 11.14 percent.

These operations, a key tool in SBP’s liquidity management arsenal, involve lending against government securities like Market Treasury Bills and Pakistan Investment Bonds for conventional transactions, and GOP Ijara Sukuk for Shariah-compliant deals, addressing funding shortfalls when banks face cash crunches.

In a separate development, the National Bank of Pakistan (NBP) conducted a corporate briefing to outline its financial performance for the first half of 2025, projecting a stable earnings outlook despite rising costs and regulatory shifts. The bank reported a significant 21.7 percent jump in deposits, reaching Rs4.7 trillion in June 2025 from Rs3.9 trillion in December 2024, driven largely by a surge in current deposits that boosted CASA (current and savings account) deposits to 82.9 percent from 79.5 percent over the same period.

NBP emphasized its strong Rs120 billion agri loan portfolio, with Rs50 billion secured by gold. Notably, during the 2022 floods, non-performing loans in this sector remained low at just 1.5 percent, underscoring robust credit quality. The bank’s investment portfolio is heavily weighted toward government securities, with 53 percent in floating-rate Pakistan Investment Bonds and 29 percent in short-term T-bills, alongside Rs70 billion in Eurobonds and Sukuk, a significant portion of which matures in FY26.

NBP disclosed that new IFRS regulations prompted it to reclassify Rs6 billion in realized gains to Other Comprehensive Income. Additionally, the central bank has incrementally raised the market risk weight on FPOCI investments, reaching 50 percent in 2025, 75 percent in 2026, and 100 percent in 2027. This year’s 50 percent adjustment reduced NBP’s Capital Adequacy Ratio (CAR) by approximately 300 basis points. Despite a Rs5 billion pension expense for the first half of 2025 being fully accounted for, pushing up the cost-to-income ratio, NBP’s CAR remains solid at 27.28 percent, well above the regulatory minimum of 13 percent.

Looking forward, NBP is prioritizing digital transformation, having processed Rs4.7 trillion in transactions over the past five years, yielding Rs13 billion in non-funded income. With a leverage ratio of 3.7 percent—exceeding SBP’s 3 percent minimum—the bank plans to assess payouts aligned with capital requirements. Future growth is anticipated to hinge on equity investments and foreign bonds as they mature, positioning NBP for sustained progress in a challenging economic landscape.