Islamabad: Inflows through the Roshan Digital Account (RDA) dropped sharply in April 2025, falling by 25% to $177 million, down from $235 million in March, according to data released by the State Bank of Pakistan (SBP).

This marks a notable slowdown in what has been a critical source of foreign exchange for the country amid ongoing liquidity challenges.

Of the total inflows in April, $24 million has been repatriated so far, while $159 million has been utilized domestically.

The number of RDA accounts also grew during the month, albeit modestly, with 8,802 new accounts opened, bringing the total to 814,244 from 805,442 at the end of March.

Cumulatively, RDA inflows reached $10.18 billion by the end of April since the initiative’s launch in September 2020.

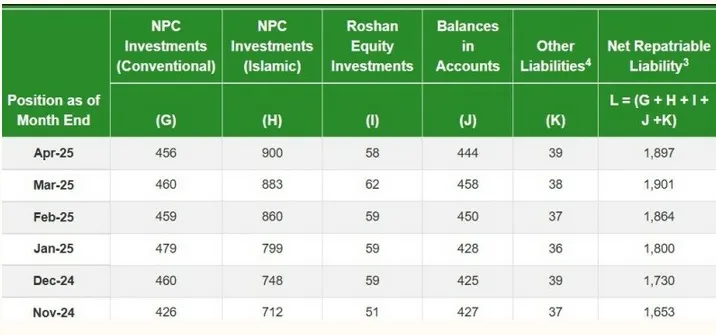

Of this total, $1.757 billion has been repatriated, and $6.527 billion has been used locally. As a result, the net repatriable liability now stands at $1.897 billion.

Breaking down this liability, $1.356 billion is invested in Naya Pakistan Certificates (NPCs), including $456 million in conventional instruments and $900 million in Islamic NPCs.

Read More: Finance Minister Urges Global Investment in Pakistan

An additional $444 million remains as balances in RDA accounts.

Meanwhile, Roshan Equity Investments, another component of the RDA portfolio, also saw a decline, slipping 6% month-on-month to $58 million in April.

The RDA initiative was launched to attract investments from overseas Pakistanis by offering competitive returns—up to 8% on US dollar-denominated investments—and ease of access.

Also Read: RDA Inflows Surge to $9.564 Billion in January 2025

While it remains a vital contributor to Pakistan’s foreign reserves, the recent decline in inflows highlights the challenges ahead in maintaining investor confidence and sustaining external financing.