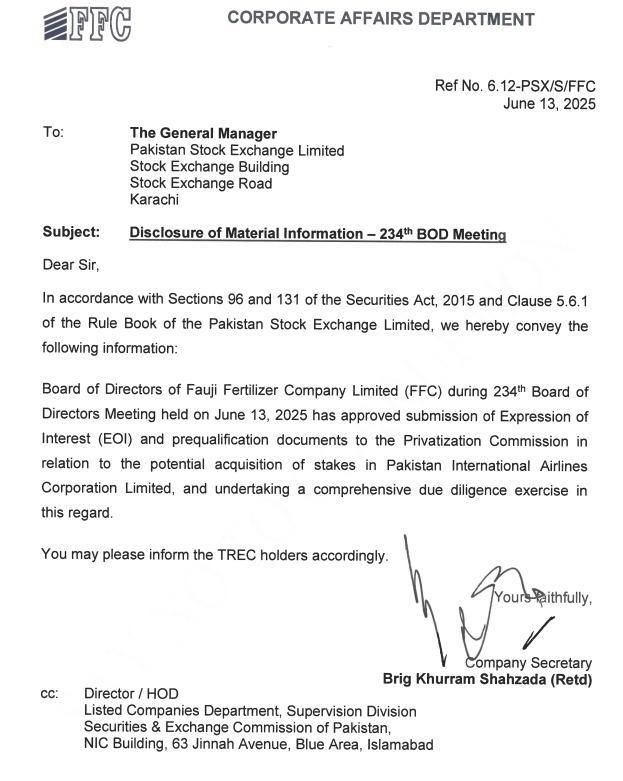

Islamabad, June 16, 2025: Fauji Fertilizer Company Ltd. (FFC), a subsidiary of the army-administered Fauji Foundation, has shown interest towards expanding its investment portfolio by acquiring stakes in financially struggling Pakistan International Airlines (PIA). The disclosure was made via an official notice filed with the Pakistan Stock Exchange (PSX).

The government in Islamabad is seeking to divest a majority share—between 51% and 100%—of PIA, as part of a $7 billion assistance package from the International Monetary Fund (IMF). This program is focused on revamping public sector enterprises. The deadline for submitting interest, initially set earlier, has now been extended to June 19, authorities confirmed.

“The board … has approved submission of an expression of interest and pre-qualification documents to the Privatization Commission … and undertaking a comprehensive due-diligence exercise,” the company stated. It also mentioned that a detailed evaluation process of the airline will be undertaken.

Fauji Fertilizer is Pakistan largest manufacturer of fertilizers. It also has other investments across the country in energy, agriculture, and financial sectors. If this acquisition goes right, it will mark the group’s entry into the aviation industry. However, the success of any potential agreement will depend on state privatization procedures and official permissions.

READ MORE: PIA Privatization Bid Scheduled for Today in Islamabad

This development signifies Pakistan’s second shot at offloading PIA.

In 2024, the government held a bidding round that attracted just a single proposal—worth Rs10 billion ($36 million) for a 60% stake—from property developer Blue World City. The offer, which fell well below the reserve price of Rs85 billion ($305 million), was turned down.

READ MORE: PIA Claims Profit-Making Belongs to PIACL, Not PIA Holding

Prior to launching the privatization bid, the government moved around 80% of PIA’s historical debt onto its own balance sheet. According to officials from the Privatization Ministry, the remaining liabilities were also cleared from the airline’s books following the failed sale, in a bid to make the carrier more appealing to future buyers.