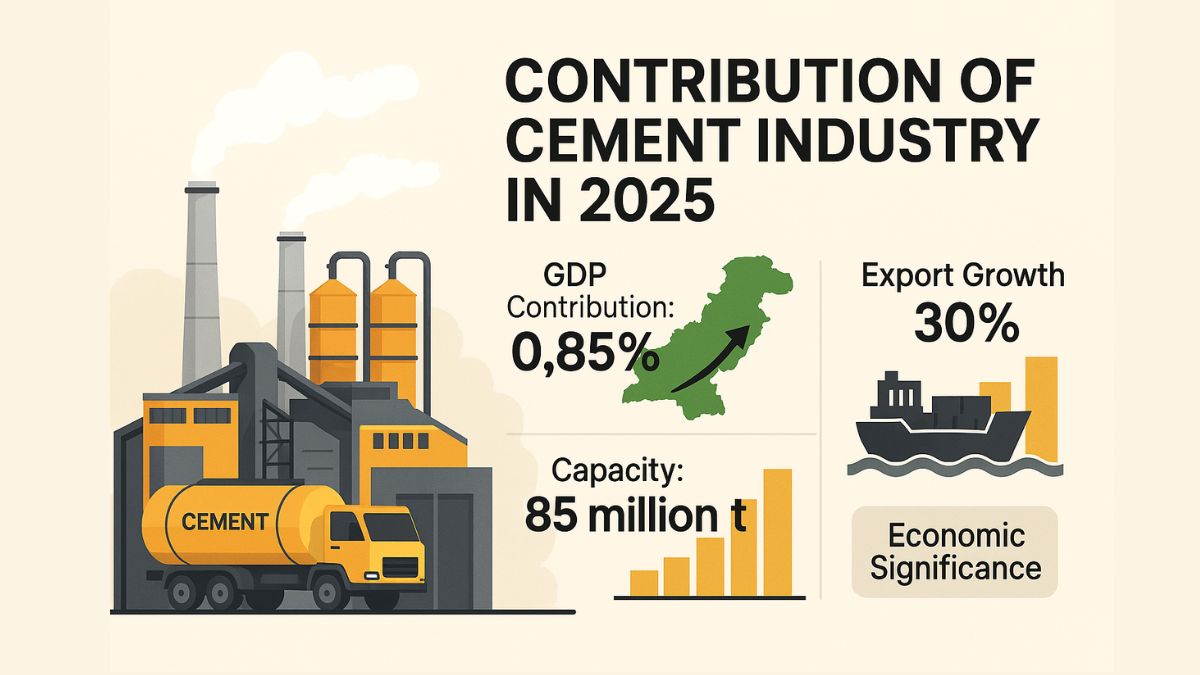

The contribution of cement industry in Pakistan plays a significant role in the country’s economy, contributing directly to the GDP, generating employment, facilitating exports, and serving as a backbone for the construction sector. Here’s a fully updated overview of its economic impact in FY 2024–25 and beyond.

FY 2024–25 Highlights

Installed Capacity & Utilization

- As of June 2025, Pakistan’s cement industry reached an installed capacity of 84.58 million tons per annum (Mtpa).

- Capacity utilization fell to 53%, reflecting challenges in domestic demand recovery despite growing exports.

Dispatches & Export Performance

- Total dispatches stood at 33.99 million tons, down 1.5% year-on-year.

- Domestic dispatches declined to 27.46 million tons (−6.6% YoY).

- Exports surged to approximately 8 million tons in 11 months (July 2024–May 2025), marking a 29.7% YoY increase.

- Export revenue crossed $287.9 million, easing the trade balance and supporting foreign exchange reserves.

Read More: Lucky Cement Clarifies Minor Incident at Iraq Plant, Operations Unaffected

Profitability

- The cement sector recorded Rs 34.7 billion in profits in Q2 FY25, reflecting a 55% YoY increase.

- EBITDA margins improved to 31.6%, supported by lower coal prices and improved energy efficiency.

- Total net sales for Q2 FY25 reached Rs 196.8 billion, with overall capacity utilization at 61%.

Growth Outlook

- AKD Securities forecasts 2.4% YoY growth in total dispatches for FY25, reaching around 45.3 million tons, driven by export momentum.

Broader Economic Impact in 2025

Direct Contribution to GDP

- The cement industry continues to contribute approximately 0.85% of Pakistan’s GDP.

- As part of large-scale manufacturing, it plays a key role in the sector’s total contribution of around 9–10% of GDP.

Role in the Construction Sector

- Cement supports the 2.5–3% of GDP that comes from the construction industry.

- It directly affects demand in steel, glass, tiles, and other related sectors.

Fiscal & Trade Benefits

- Export-led performance helped offset the slowdown in domestic demand, contributing to national revenue through duties and corporate taxation.

- The industry remains crucial to Pakistan’s strategy of increasing exports and stabilizing macroeconomic indicators.

Read More: Punjab Cement Firms: Royalty Appeal Rejected, Disparity with KPK Persists

Employment & Industrial Linkages

- The sector supports over 150,000 direct and indirect jobs.

- It drives a major chunk of allied industries and supply chains across transportation, mining, energy, and packaging.

2025 Outlook & Strategic Priorities

- Export Diversification: Expansion into Africa, the Middle East, and Central Asia continues.

- Energy Efficiency: Transition to alternative fuels and green technologies is helping improve margins.

- Domestic Demand Recovery: Reliant on public infrastructure spending, housing schemes, and macroeconomic stability.

- Risks: High FED/duties, inflation, exchange rate volatility, and inconsistent government policies.

Conclusion

Despite low domestic consumption, Pakistan’s cement industry remained profitable and resilient in 2025 due to strong exports and cost optimization. With a consistent ~0.85% share in GDP and essential linkages to construction, trade, and industry, the sector continues to be a key pillar of Pakistan’s economy. Policy support, export incentives, and sustainable practices will be vital to ensure the sector’s long-term growth and contribution to GDP. Stay tuned with Bloom Pakistan

Read More: Fauji Cement Price in Pakistan Today – Updated Rates 2025