Islamabad, July 3, 2025: Pakistan’s banking sector is seeing record profits. However, this is not because of new business ideas or risky investment. The main reason is that banks are putting most of their money into safe government securities instead of giving loans to the private sector. Small and medium businesses, along with startups, are the most affected by this.

As of June 2025, banks invested almost all their deposits into government papers. The Investment-to-Deposit Ratio reached 100.8 percent. This shows that banks are not lending to businesses, especially SMEs as the Advance-to-Deposit Ratio dropped to just 37 percent, far below the normal range of 80 to 90 percent.

Banks find it easy to make money by buying government bonds and treasury bills. These investments offer high returns without any risks. Moreover, high policy rate up to 22 percent in 2024, has made government lending more profitable for banks.

In December 2024, banks had Rs30.3 trillion in deposits. Out of this amount, almost 96 percent was used to buy government securities instead of supporting businesses.

READ MORE: Finance Minister Meets World Bank Delegation

However, small businesses continue to struggle for financing as less than 5 percent of total loans are going to the SME sector. This sector is the core of creating jobs and boosting the economy. The total amount of SME loans reached Rs478 billion by September 2024, showing only a slight rise over the last five years.

Government programs, including a Rs1.1 trillion SME plan, have failed to push banks to lend more to this sector. High interest rates and easy government lending keep banks focused on safer options.

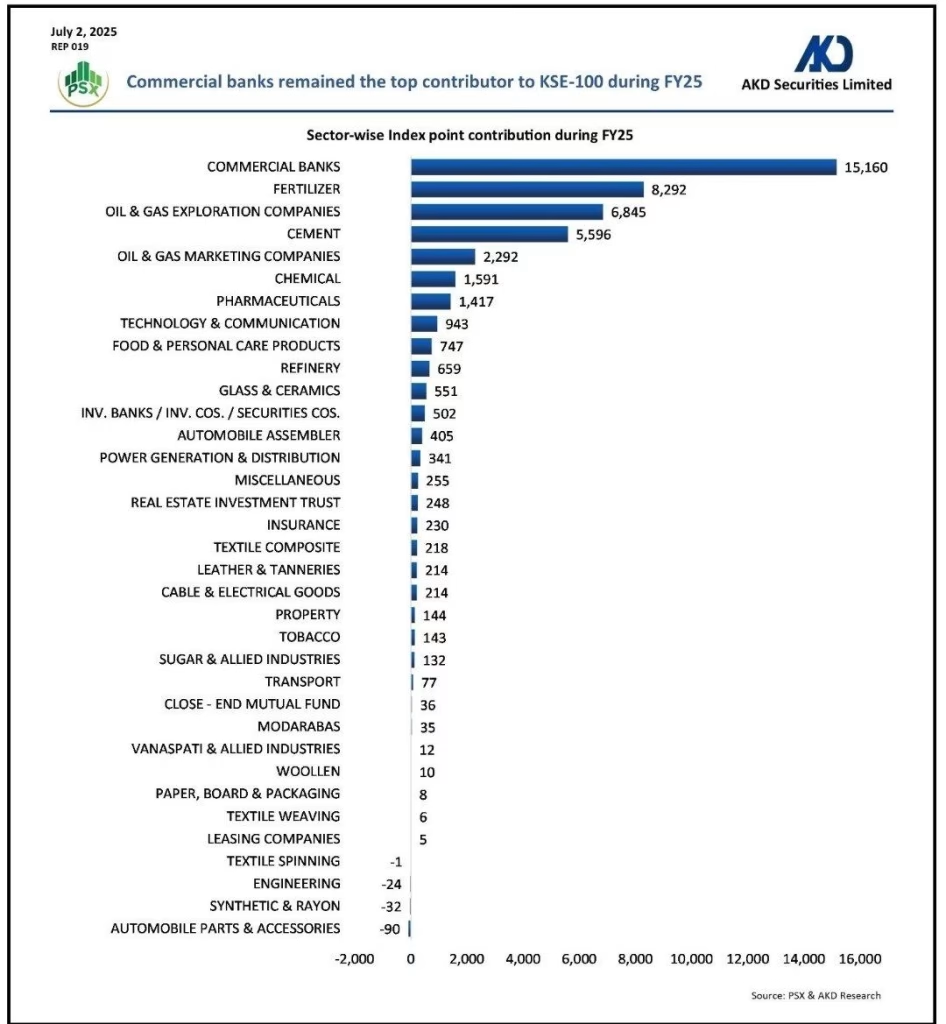

Bank profits increased by 14 percent in early 2025. Their earnings mostly came from government securities, not from lending to businesses. This raises concerns about the real impact on the economy.

READ MORE: Pakistan Seeks US Investment in Mining Sector

The State Bank of Pakistan has warned banks many times to focus more on business lending. Experts say that as long as interest rates remain high, banks will continue to prefer government lending. This will harm long-term economic growth.

In the end, while banks are enjoying high profits, their lack of support for businesses is holding back the economy. Policymakers now face a tough question — are banks helping the economy grow, or are they just earning from government borrowing?