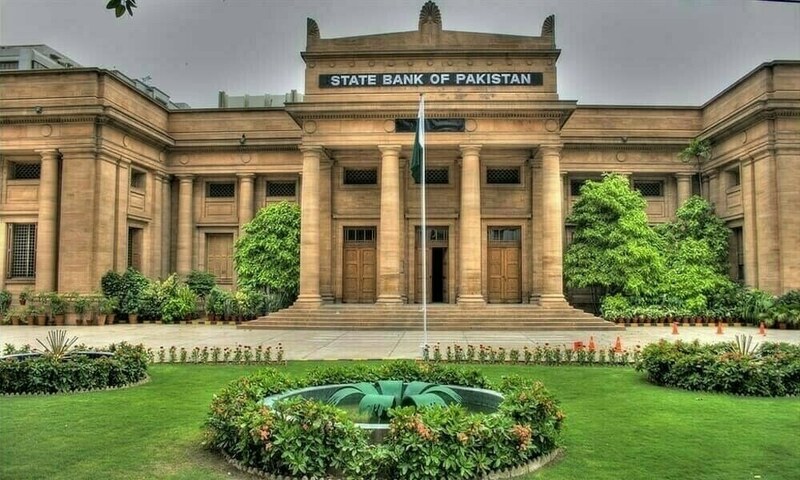

In an attempt to work on the efficiency of the financial transactions that take place in the state, the State Bank of Pakistan (SBP) has introduced Prism Plus, a state of the generation payment and settlement platform which will enhance the efficiency, speed and security of financial transactions in the country.

Addressing the inaugural ceremony at the National Institute of Banking & Finance (NIBAF), Pakistan SBP Governor, Jameel Ahmad outlined the new system as an important advance in Pakistani banking and financial infrastructural development. Based on the international ISO 20022 messaging standard, Prism Plus places the country in line with international trends in digital payments as well as increasing transparency in government securities markets.

The drive develops on the changes that have started with the 2017 modernization of the Pakistan Real-time Interbank Settlement Mechanism (PRISM). In the year 2024, 1,430 billion rupees worth of transactions have been processed on PRISM, and that is almost ten times the GDP of the country, which gives testimony to its role in facilitating business operations and contributing towards the digitalization of the Pakistani economy.

Governor Ahmad pointed out to the increasing impact of digitalisation due to the number of active bank accounts exceeding 225 million and the increase in the volume of digital transactions, the impact of which is assisted by World Bank to modernise the financial system.

Read more: State Bank of Pakistan Cuts Interest Rate Again

Foreign exchange reserves of Pakistan also enhanced to the tune of 11 million dollars in the current week bringing the SBP reserves and the sum of overall liquid resources to 14.24 billion and 19.50 billion respectively on August 8. This shows a huge turnover of the low point during the middle of 2023 at below the $4-billion mark.

This has been enabled by the strengthening of reserves via IMF-sponsored programmes, economic diplomacy, and increased remittance channels that are part of a wider movement towards stabilization and modernization of the Pakistan economy. The introduction of Prism Plus also highlights the effort of SBP on the progressive digital financial space of the country.