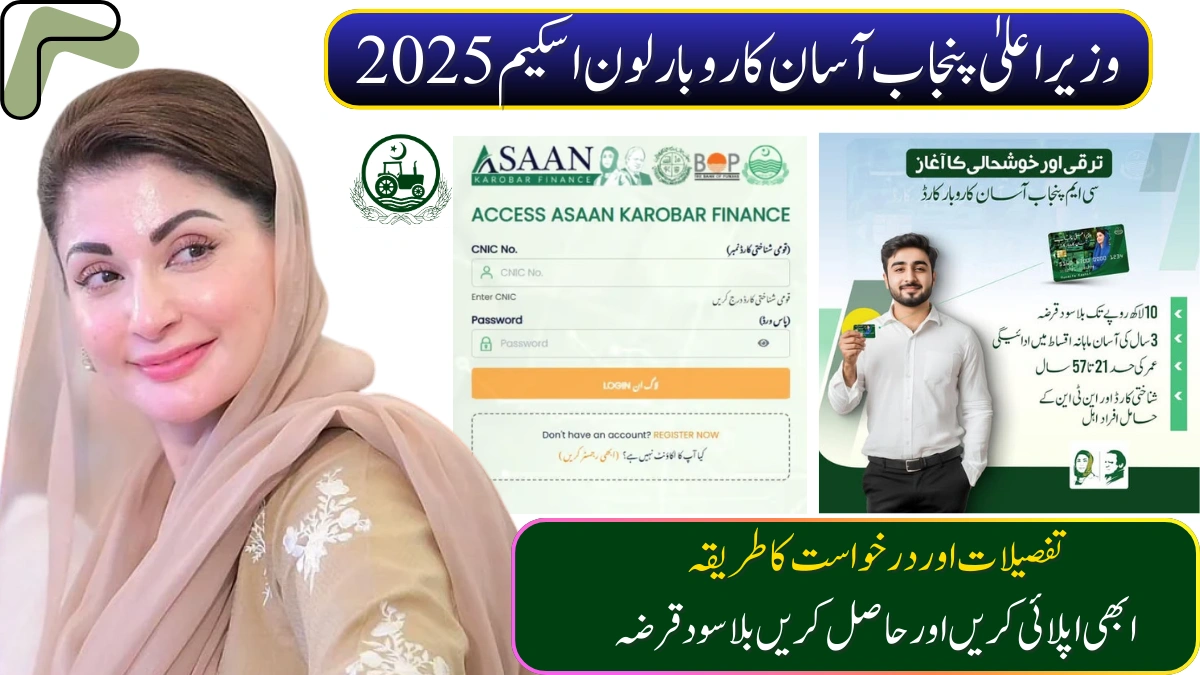

The Asaan Karobar Loan Scheme, recently launched under the vision of CM Punjab Maryam Nawaz Sharif, is a groundbreaking initiative designed to empower entrepreneurs, small businesses, and startups across the province. This interest-free financing program is focused on driving economic stability, encouraging innovation, and helping young as well as experienced business owners turn their ideas into reality.

With a strong emphasis on supporting women, youth, rural startups, and underprivileged groups, the scheme ensures that financial limitations never become an obstacle for promising entrepreneurs.

What Does the Asaan Karobar Loan Scheme Offer?

Also recognized as the Asaan Karobar Finance Scheme, this program offers three main financing options:

- Tier 1: Unsecured loans of up to PKR 5 million, available with only a personal guarantee.

- Tier 2: Secured loans between PKR 6 million and PKR 30 million, backed by collateral.

- Asaan Karobar Card: Instant financial assistance up to PKR 1 million without the need for collateral.

This flexible structure allows both new and existing businesses to select funding that matches their requirements.

Eligibility Criteria

To qualify for the Asaan Karobar Loan Scheme, applicants must meet the following conditions:

- Must be a permanent resident of Punjab with a valid CNIC.

- Age limit: 25 to 55 years.

- For running businesses, official registration and operational proof are mandatory.

- A clean credit history is required.

- Submission of a viable business idea or expansion plan.

- Special preference is given to women, differently-abled individuals, youth, and entrepreneurs from rural areas.

Read More: Good News: CM Punjab Honahar Scholarship 2025 – Apply with 65% Marks Only

How to Apply

The application process for the Asaan Karobar Loan Scheme is simple and transparent:

- Register online at the official portal of CM Punjab Asaan Karobar Finance Scheme.

- Select the loan tier that suits your financing requirement.

- Upload necessary documents such as CNIC, business plan, bank statements (for existing businesses), collateral details (for Tier-2), and passport-size photos.

- Pay the processing fee:

- PKR 5,000 for Tier-1 loans.

- PKR 10,000 for Tier-2 loans.

- Once approved, the loan amount will be directly transferred to the applicant’s bank account.

Loan Structure at a Glance

| Loan Type | Amount | Collateral Requirement | Processing Fee | Tenure | Grace Period |

|---|---|---|---|---|---|

| Tier 1 | Up to PKR 5 million | Personal guarantee only | PKR 5,000 | Up to 5 years | 6 months (new) / 3 months (existing) |

| Tier 2 | PKR 6–30 million | Collateral required | PKR 10,000 | Up to 5 years | 6 months (new) / 3 months (existing) |

| Asaan Karobar Card | Up to PKR 1 million | None | N/A | Flexible | Immediate access |

The Asaan Karobar Loan Scheme 2025 stands as a lifeline for thousands of entrepreneurs who dream of starting or expanding their businesses. By providing interest-free loans, CM Punjab’s government is not only reducing financial pressure but also opening doors for innovation, job creation, and economic development.