Karachi, August 20, 2025 — Unilever Pakistan Foods Limited (UPFL) has announced its financial results for the first half of 2025, posting solid revenue growth but a significant decline in profitability due to lower other income, higher finance costs, and increased taxation.

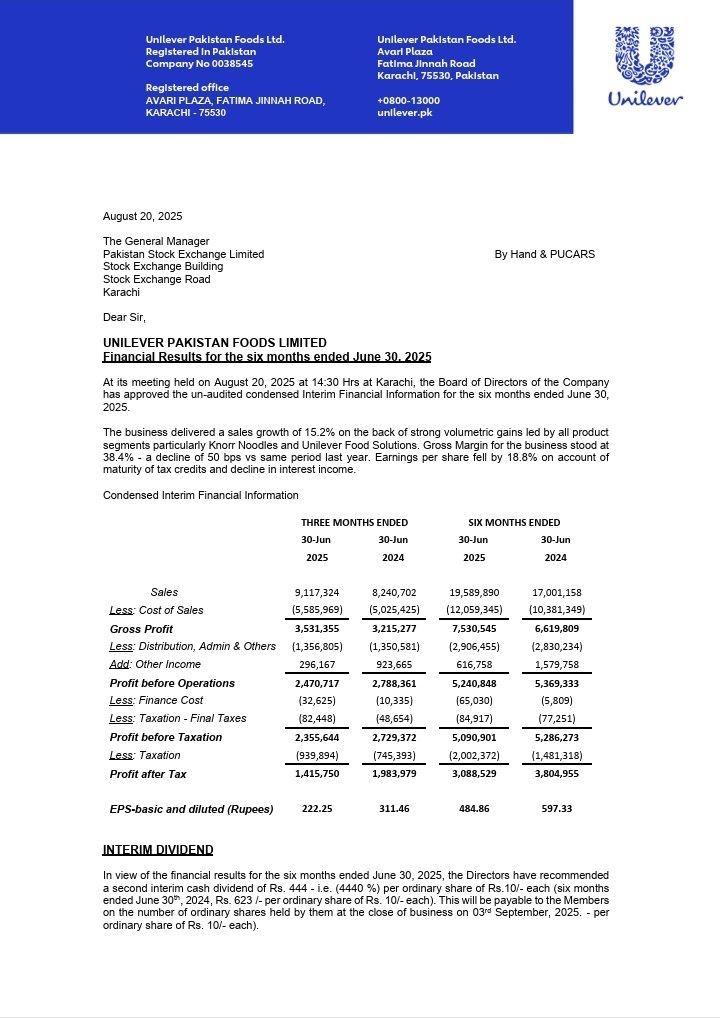

According to the company’s unaudited condensed interim financial statements for the six months ended June 30, 2025, sales rose 15.2% year-on-year to PKR 19.59 billion, compared with PKR 17.00 billion in the corresponding period last year. The growth was attributed to strong volumetric gains across categories, particularly from Knorr Noodles and Unilever Food Solutions.

ICC Strikes Landmark Deal with Unilever to Elevate Women’s Cricket

READ MORE

Profitability Pressures

While gross profit increased to PKR 7.53 billion from PKR 6.62 billion in the previous year, profitability came under strain. Other income fell sharply by 61%, amounting to PKR 616 million against PKR 1.58 billion a year earlier, mainly on account of the maturity of tax credits and lower interest earnings.

Finance costs also jumped significantly, rising to PKR 65 million compared with just PKR 6 million last year. In addition, taxation surged to PKR 2.00 billion from PKR 1.48 billion, further squeezing net earnings.

As a result, profit after tax declined 18.8% to PKR 3.09 billion, compared with PKR 3.80 billion in the first half of 2024. Earnings per share (EPS) decreased to Rs 484.86 from Rs 597.33.

Unilever Pakistan and Easypaisa Launch Campaign to Protect OOH Fitters’ Lives

READ MORE

Interim Dividend

Despite the decline in profitability, the Board of Directors recommended a second interim cash dividend of Rs 444 per share, equivalent to 4,440% of the nominal value of Rs 10. This compares with last year’s payout of Rs 623 per share for the same period.

Future Outlook

The company expressed confidence in its long-term performance, pointing to improving macroeconomic indicators. With inflation stabilizing at low single digits and a rising Business Confidence Index, UPFL expects consumer demand to remain resilient, supporting sustained growth in Pakistan’s food and beverages sector.

Key Figures (Jan–Jun 2025 vs. Jan–Jun 2024)

- Sales: PKR 19.59 bn vs. PKR 17.00 bn (+15.2%)

- Gross Profit: PKR 7.53 bn vs. PKR 6.62 bn (+13.8%)

- Other Income: PKR 616 mn vs. PKR 1.58 bn (–61%)

- Profit After Tax: PKR 3.09 bn vs. PKR 3.80 bn (–18.8%)

- EPS: Rs 484.86 vs. Rs 597.33

- Dividend: Rs 444/share vs. Rs 623/share last year