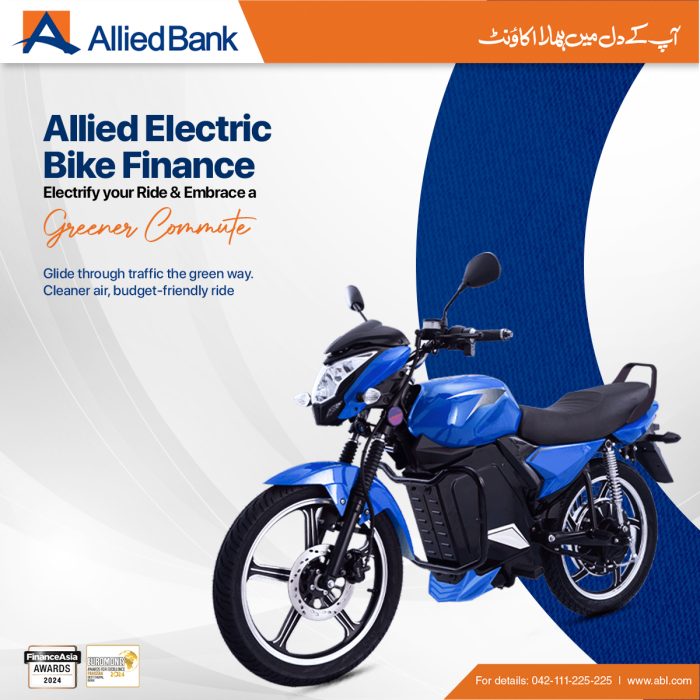

Islamabad, May 12, 2025: In a major step toward sustainable commuting, Allied Bank has rolled out an electric bike financing scheme in Pakistan, making it easier for everyday consumers to switch to eco-friendly transport without the burden of upfront costs.

This initiative is a timely response to rising petrol prices and growing environmental concerns in urban centers like Lahore, Karachi, and Islamabad.

Instead of paying the full amount upfront, customers can now opt for manageable monthly installments. This move not only makes electric bikes in Pakistan more accessible but also promotes cleaner, more affordable travel alternatives.

Compared to traditional petrol-powered motorcycles, electric bikes offer reduced maintenance and zero fuel costs — a game-changer for budget-conscious commuters.

The financing scheme primarily targets working individuals, students, and delivery riders who rely heavily on two-wheelers for daily travel.

As per recent market analysis, demand for electric vehicles in Pakistan has surged by over 25% in the past year, a trend expected to grow further with supportive financial options like this.

Read More: Rawalpindi to Get Two New Underpasses and a Flyover to Ease Traffic

“This initiative reflects our commitment to green mobility and helping customers cope with inflation-driven fuel costs,” said a representative from Allied Bank.

To apply, interested individuals can contact Allied Bank’s helpline at 042-111-225-225 or visit the official website for full eligibility criteria and application details.

As financial institutions adapt to the energy transition, Allied Bank’s electric bike financing plan positions it as a frontrunner in Pakistan’s green transport revolution.