Islamabad: In a significant diplomatic meeting held at the Ministry of Commerce in Islamabad, Federal Minister for Commerce, Jam Kamal…

Author: Bloom Pakistan

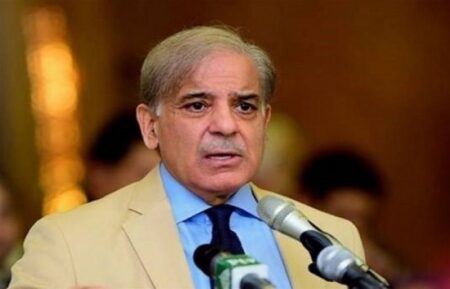

ISLAMABAD: Prime Minister Shehbaz Sharif on Monday ordered an immediate release of Rs 23 billion to resolve the issues confronting…

At initiative of the Embassy of Brazil and of the Embassy of Portugal, together with the support of Instituto Guimaraes…

Riyadh, May 12, 2024, SPA — Under the patronage of His Royal Highness Prince Mohammed bin Salman bin Abdulaziz Al…

Islamabad: Highlighting the precarious state of Pakistan’s economy, the International Monetary Fund (IMF) issued a warning on Friday, stating that…

Karachi: Exciting developments await Pakistanis residing in the UK and Europe as Pakistan International Airlines (PIA) announces the resumption of…

Prime Minister’s Coordinator for Climate Change Romina Khurshid Alam on Saturday said the Republic of Azerbaijan and Pakistan would focus…

Prime Minister Muhammad Shehbaz Sharif on Saturday appreciated the outstanding performance of the players of Pakistan National Hockey Team in…

Islamabad: According to a brief statement from Esther Perez Ruiz, the Resident Representative of the International Monetary Fund (IMF) in…

Repatriation of illegal foreign nationals including Afghans to their homeland is continuing in a dignified and safe manner. 567, 554…