Islamabad, 14 June 2025: Bitcoin Price continues to fluctuate in the face of global uncertainty, particularly during sharp movements in oil markets.

While digital currencies are typically viewed as high-risk assets during geopolitical upheaval, historical performance suggests that sudden drops in Bitcoin price may offer opportunities for strategic investors.

Market analysts often note that during rising tensions, such as conflicts or sanctions, investors tend to shift capital into low-risk instruments like short-term government bonds and cash.

READ MORE: Bitcoin Price Falls Today Below $77K, Crypto Market Loses $1.3 Trillion

As oil surged to $77 per barrel this past Friday, Bitcoin price slipped from $110,200 to $102,800, a nearly 7% decline over just three days. This inverse movement aligns with Bitcoin’s profile as a “risk-on” asset that tends to retreat during uncertain times.

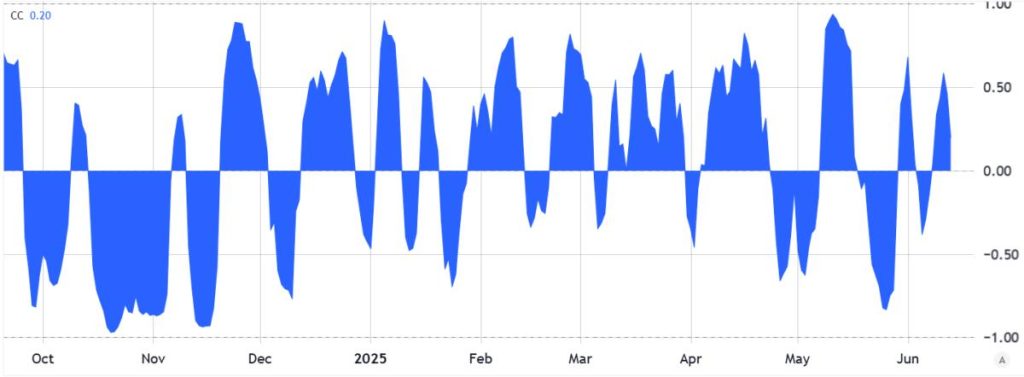

Short-term charts reveal a recurring pattern: oil spikes often precede rapid but brief corrections in Bitcoin. However, broader data reveals that these dips are frequently followed by robust recoveries. In fact, over the past year alone, at least three significant rebounds occurred following similar oil-related downturns.

One such instance took place in January 2025, when US sanctions targeting Russia’s energy exports caused oil prices to jump from $72.50 to $80.50 in under a week. Bitcoin simultaneously dropped to $89,300, only to rebound by 22% to $109,300 within seven days.

Back in October 2024, terrorist attacks in the Middle East pushed oil to $77.50, triggering a Bitcoin correction to $58,900. Yet, within eight days, the cryptocurrency surged 16%, closing at $68,960.

A similar scenario unfolded in August 2024, when unrest in Libya forced temporary shutdowns of key oil fields. Oil jumped from $74 to $80, while Bitcoin fell to $56,150. Within just over a week, Bitcoin rallied by 16%, reaching $65,000.

Despite short-term volatility, analysts say there’s no clear, long-term correlation between oil prices and Bitcoin price. Still, extreme energy price movements often coincide with market overreactions that later correct themselves giving savvy traders a window to capitalize.

READ MORE: US Investment Firm Predicts Bitcoin Price Could Skyrocket to $2.4 Million per Coin

As oil again touches a five-month high, some investors are eyeing Bitcoin’s current level near $102,800 as a potential entry point, with a speculative target of $119,200 by June 21, assuming the trend holds.