Islamabad, May 8, 2025: Chengdu Aviation, the Chinese aerospace company known for manufacturing the advanced J-10C and JF-17 fighter jets, has witnessed an unprecedented rise in its stock performance.

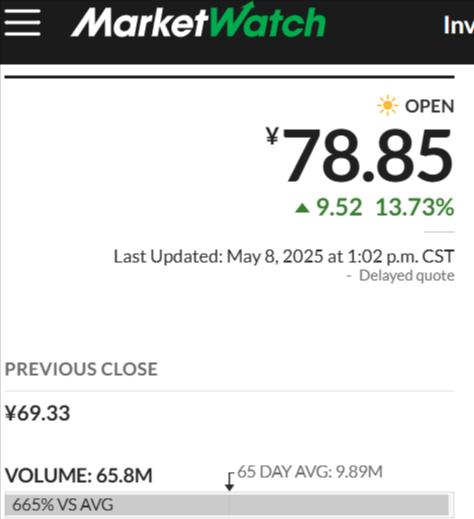

In just two days, the company’s shares have surged over 36%, triggering excitement in the defense and investment sectors alike.

What has caught even more attention is the staggering 665% increase in trading volume, suggesting a massive inflow of market activity and investor interest.

The sharp uptick is being attributed to a combination of factors. Firstly, heightened geopolitical tensions in the Asia-Pacific region have led to increased demand for advanced military aircraft.

The J-10C, equipped with modern radar and avionics, and the JF-17, jointly developed with Pakistan, are considered highly capable yet cost-effective alternatives to Western fighter jets.

As a result, defense analysts believe Chengdu Aviation is poised to gain new export orders in the near future.

Secondly, recent reports from Chinese media suggest that Chengdu Aviation may have secured or is close to securing new international contracts, which has likely sparked optimism among investors. Speculation surrounding possible deals with countries in Africa, the Middle East, and Southeast Asia is also adding fuel to the rally.

Read More: Bangladesh Interested in Pakistan’s JF-17 Fighter Jets

The JF-17, in particular, has already been exported to nations such as Nigeria and Myanmar, with ongoing discussions in several other regions.

Moreover, the Chinese government’s increasing focus on strengthening domestic military production and reducing reliance on foreign technologies has created a favorable policy environment for companies like Chengdu Aviation.

State support and subsidies for defense firms often result in improved revenue forecasts and higher stock valuations.

Financial analysts caution that while the rally is impressive, investors should remain aware of market volatility, especially in sectors influenced by international relations and defense spending.

However, the long-term outlook remains strong if Chengdu Aviation continues to innovate and expand its global footprint.

In summary, Chengdu Aviation’s 36% stock surge and 665% rise in trading volume over just two days reflect growing investor confidence and potential global demand for Chinese fighter jets.

With advanced products and possible international deals on the horizon, the company appears set to play a larger role in the global defense aerospace market.