Export Processing Zones (EPZs) in Pakistan are designated industrial areas aimed at promoting export-oriented industrialization, attracting foreign direct investment (FDI), and generating employment. Administered by the Export Processing Zones Authority (EPZA), these zones offer special incentives and infrastructure to investors focused on manufacturing for export.

What Are EPZs?

EPZs are specialized industrial estates where companies can import raw materials, manufacture goods, and export them with significant tax exemptions, duty-free benefits, and logistics support. Established under EPZA Ordinance IV of 1980, they are key instruments in Pakistan’s export promotion strategy.

Read More: Organic Meat Company Ltd Becomes First Pakistani Firm to Export Beef Casings to Europe

Key EPZ Locations in Pakistan (2025)

| EPZ Name | Location | Key Sectors | Type | Remarks |

|---|---|---|---|---|

| Karachi EPZ (KEPZ) | Karachi, Sindh | Garments, Electronics, Textiles | Public | Major zone near Port Qasim |

| Landhi EPZ | Karachi, Sindh | Textiles | Public | Recently affected by fire incident |

| Sialkot EPZ | Sialkot, Punjab | Surgical Instruments, Sports Goods | Public | Specialized export goods |

| Gujranwala EPZ | Gujranwala, Punjab | General Manufacturing | Public | Small to medium industries |

| Risalpur EPZ | Khyber Pakhtunkhwa | Mixed Industries | Public | Strategic KP zone |

| Duddar/Saindak EPZs | Balochistan | Minerals, Copper, Gold | Public | Located in resource-rich areas |

| Siah Dik EPZ | Chagai, Balochistan | Copper Mining & Processing | Private JV | Approved in 2025, under development |

Facilities Offered in EPZs

Investors in EPZs are provided with comprehensive infrastructure and business-friendly policies, including:

- Duty-free import of machinery, raw materials, and vehicles

- 100% foreign ownership and repatriation of profits

- Tax holidays and exemptions from sales tax

- Custom-bonded warehousing facilities

- Utility connections and one-window facilitation

- On-site customs clearance

- Long-term land leasing (typically 30 years)

Incentives for Investors

| Incentive Type | Details |

|---|---|

| Import & Tax Incentives | Duty-free imports; no sales tax; no import licenses needed |

| Export Incentives | Presumptive tax at 1% (final tax); unrestricted foreign exchange usage |

| Ownership & Repatriation | Full ownership; 100% capital and profit repatriation allowed |

| Infrastructure | Purpose-built zones; bonded warehouses; utilities; customs offices |

| Domestic Market Access | Up to 20% production can be sold in local market (with duty) |

Recent Developments (2025)

Siah Dik EPZ – Balochistan

- Type: Private/Public Joint Venture

- Sector: Copper mining and processing

- Area: 296 acres (plus lease land)

- Timeline: 3-year development plan (by 2027)

- Developers: China Metallurgical Group (CMGC) and local stakeholders

- Policy Framework: Enabled by EPZA’s Private Sector Rules, 2023

Landhi EPZ Fire Incident

- In June 2025, a major fire broke out in the Landhi EPZ causing significant damage to textile export units.

- This has sparked a national conversation on safety protocols and EPZ infrastructure upgrades.

Read More: Beef Meat Buyers in China 2025: Top Importers, Market Demand and Export Opportunities for Pakistan

Challenges

| Challenge | Impact |

|---|---|

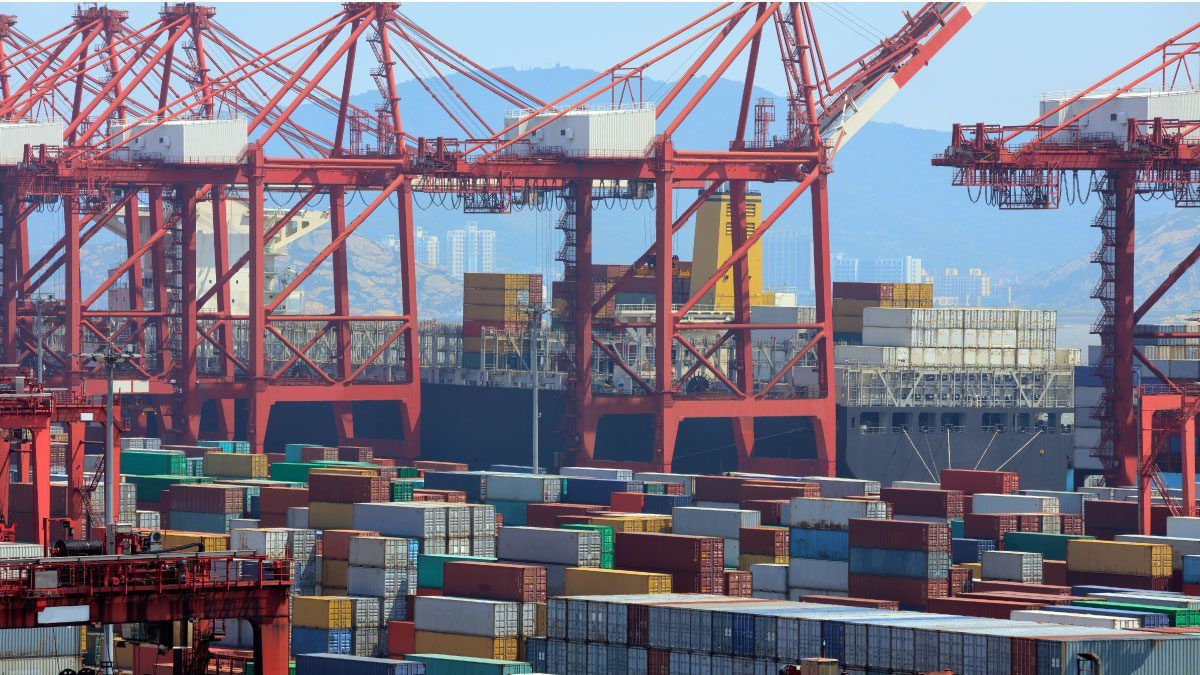

| Port Qasim Clearance Delays | Container backlogs due to SOP infrastructure gaps |

| Safety Infrastructure | Fire hazards at Landhi highlight need for fire suppression systems |

| Policy Uncertainty | IMF conditions may impact future incentives or zone expansion |

| Logistics & Customs Bottlenecks | Delay in EPZ-bound container clearance affects supply chain timelines |

Investment Opportunities

- Mining EPZs: Copper and rare earth processing through new zones like Siah Dik

- Logistics Services: Opportunities in bonded trucking, warehousing, and cranes

- Textile Diversification: Modernized units in KEPZ and Landhi for value-added garments

- IT & Electronics: High-potential export sectors under EPZ tax frameworks

- Public-Private Zones: Upcoming zones offer partnerships for land, infrastructure, and operations

Conclusion

Export Processing Zones in Pakistan continue to play a vital role in fostering export-led growth. With competitive incentives, improving infrastructure, and growing interest from private investors, 2025 is a pivotal year. Projects like Siah Dik EPZ in Balochistan mark a shift toward resource-sector value addition, while traditional hubs like Karachi and Sialkot remain essential to Pakistan’s industrial output. Ensuring policy stability, fire safety, and smoother customs processes will be key to future success.

Read More: How to Export a Car to Pakistan in 2025: Complete Process, Rules & Customs Duties Guide