KARACHI, April 08: Pakistan-based fintech firm Haball has raised $52 million in a landmark funding round aimed at scaling its shariah-compliant supply chain financing and digital payment services, the company announced on Tuesday.

The funding round, led by Zayn VC and Meezan Bank, includes $5 million in equity and $47 million in strategic financing, and is set to accelerate Haball’s growth within Pakistan and into the Middle East, starting with Saudi Arabia later this year.

“Supply chain finance in Pakistan is nascent but has the potential to exceed $9 billion, driven by a severe financing gap in the SME sector — where fewer than 5% have access to commercial bank financing,” the company stated.

The investment highlights the rising demand for Islamic fintech solutions in Pakistan, which is the world’s second-largest Muslim-majority country.

According to the State Bank of Pakistan’s Islamic Banking Bulletin, Islamic banking assets reached PKR 9.69 trillion ($34.5 billion) by June 2024, with market shares of 18.8% in assets and 22.7% in deposits.

Read More: Meezan Bank & NED University Collaborate on Islamic Finance & FinTech Hub

The central bank aims to push Islamic banking to 30% of the overall sector under its 2023–2028 strategic plan.

Haball Background

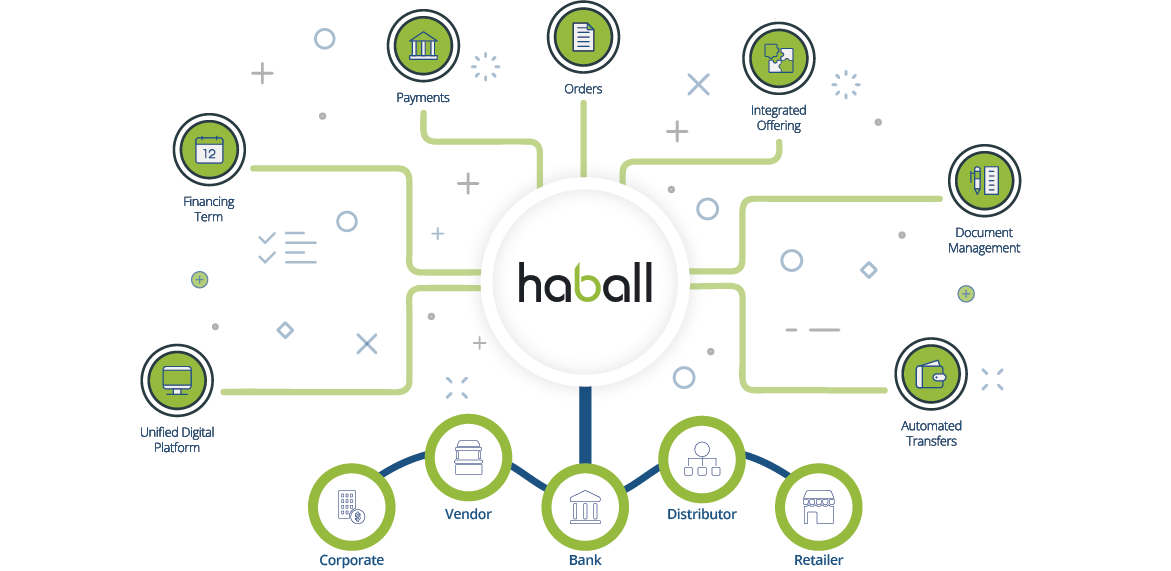

Founded by Omer bin Ahsan, Haball has already made significant inroads, offering Shariah-compliant financing to nearly 8,000 SMEs and multinationals. Its services include digital invoicing, payment collection, and tax compliance tools.

“We’ve processed over $3 billion in payments and disbursed more than $110 million in financing to optimize supply chains nationwide,” said Ahsan.

Haball’s growing traction aligns with broader regional trends. Dubai was recently ranked among the top five global fintech hubs, underscoring the potential for Pakistani fintechs to scale regionally.

Also Read: Digital Transactions Dominate 88% of Retail Payments in Pakistan

Islamic finance, which prohibits interest and speculative investment, continues to appeal to both ethically-conscious and underserved markets, offering alternative financing structures rooted in asset-backed, transparent principles.