In today’s fast-paced digital economy, sending and receiving money through an e transfer application has become an everyday activity for individuals and businesses alike. Whether you’re splitting a bill at a restaurant or making a payment to a freelancer overseas, e transfer apps offer a quick, convenient, and secure way to move money in just a few taps.

With more people shifting to cashless transactions in 2025, knowing how to use these apps effectively is essential.

What is an E Transfer Application?

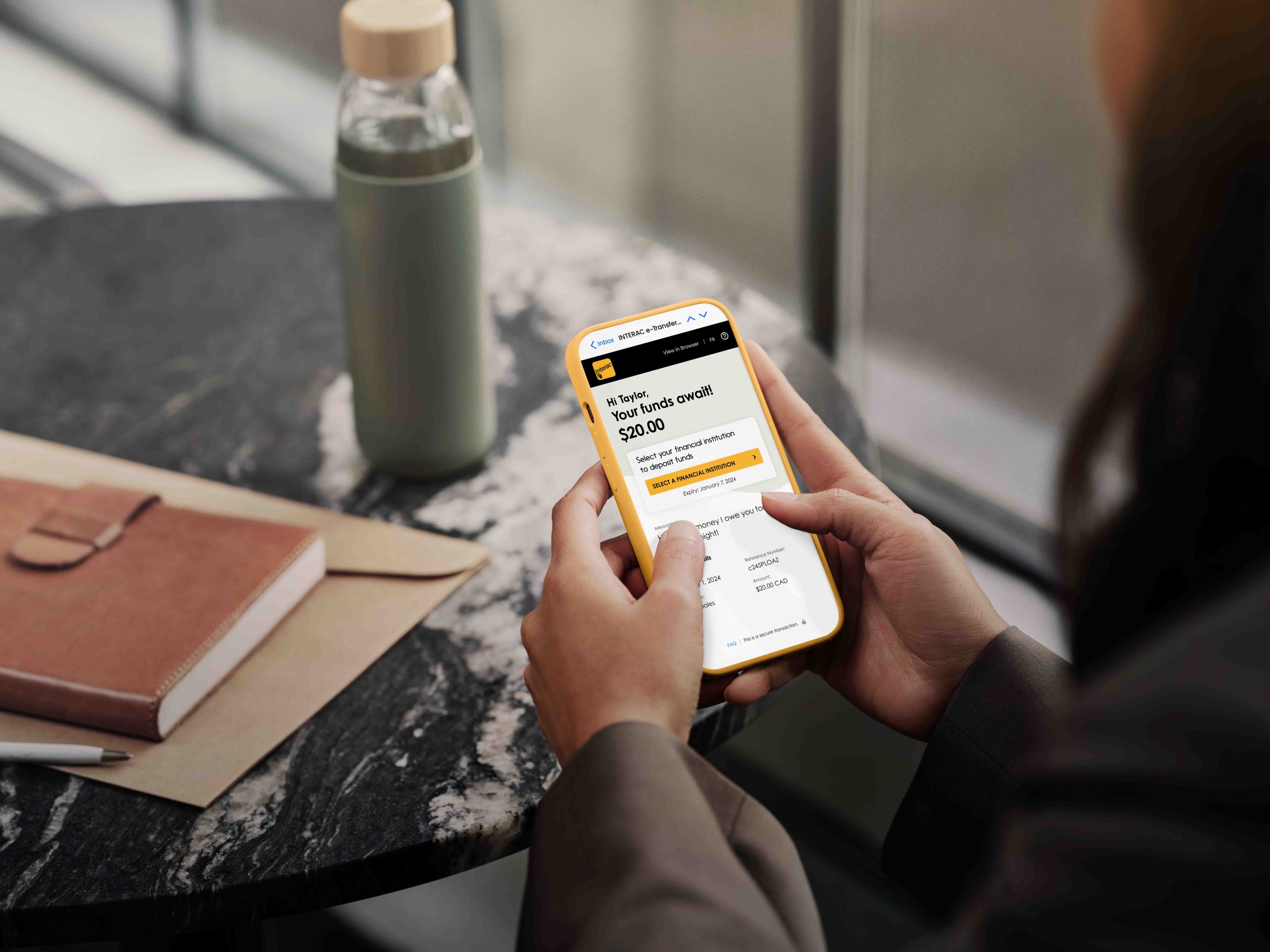

An e transfer application is a digital platform that allows users to electronically send money from one bank account to another using the internet or mobile network. These apps typically connect to your bank account or credit card and facilitate instant transfers using the recipient’s email address, phone number, or unique ID. Popular examples include Interac e-Transfer in Canada, Zelle in the U.S., and Easypaisa and JazzCash in Pakistan.

Unlike traditional banking methods, there’s no need for a cheque or waiting in line. The entire process takes a few seconds to a few minutes, depending on the bank and application involved.

Why E Transfer Applications Are Gaining Popularity

The rise of e transfer applications is closely tied to the growing reliance on smartphones and digital banking. People now prefer apps that are fast, secure, and user-friendly. Here are some reasons for their increasing popularity:

- Speed: Most e transfers are completed within minutes, making them ideal for urgent payments.

- Convenience: Send money from anywhere, anytime, without visiting a bank.

- Low fees: Many apps offer free or low-cost transfers compared to traditional wire services.

- Security: Strong encryption and two-factor authentication make them safer than carrying cash.

Best E Transfer Applications in 2025

While many apps serve this purpose, a few stand out for their features and reliability. If you’re looking to install a reliable e transfer application, consider the following options:

- Wise (formerly TransferWise) – Ideal for international money transfers with low fees.

- Zelle – Great for domestic transfers in the U.S. with no fees.

- Interac e-Transfer – Popular in Canada for peer-to-peer transfers.

- JazzCash/Easypaisa – Widely used in Pakistan for local payments and mobile banking.

- PayPal – Global coverage, good for both business and personal transfers.

Before choosing, always check user reviews, security features, transfer limits, and compatibility with your bank.

How to Use an E Transfer Application Safely

Security is a top concern when transferring money digitally. While most apps offer built-in protections, users must follow best practices to stay safe:

- Use strong passwords and update them regularly.

- Enable two-factor authentication for an extra layer of security.

- Avoid using public Wi-Fi when making financial transactions.

- Verify recipient details before sending any amount.

- Keep app and phone software updated to prevent vulnerabilities.

By following these steps, you reduce the chances of unauthorized access or fraud.

Common Mistakes to Avoid

Even the best e transfer application can’t protect you if you’re careless. Avoid these mistakes:

- Sending to the wrong recipient due to a mistyped phone number or email.

- Not confirming transfer amounts.

- Ignoring transaction receipts or not saving confirmation numbers.

- Sharing personal bank or app credentials with others.

Always double-check your details before finalizing the transfer.

The Future of E Transfers

The future of e transfer applications is bright. With innovations like biometric verification, blockchain integration, and real-time cross-border transfers, the financial world is becoming more seamless. More governments are also encouraging digital payments to support financial inclusion, making e transfers an integral part of everyday life.

Read More: Final Trailer for ‘Squid Game’ Season 3 Released

Using an e transfer application is no longer just a convenience—it’s a necessity in the digital economy of 2025. Whether for business transactions or personal payments, these apps save time, reduce risks, and simplify money transfers like never before. Just make sure you choose a reliable app, stay updated with security practices, and verify every transaction to get the most out of your digital payment experience.

Read More: Punjab to Open Teacher Transfer Applications Next Week