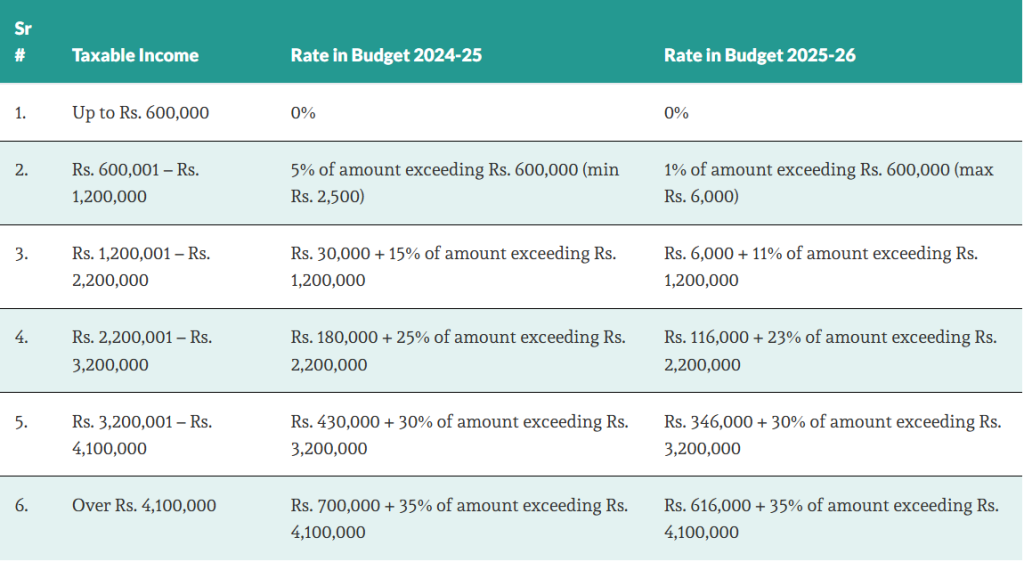

ISLAMABAD – June 10, 2025: The new income tax slabs for the salaried class under the federal budget 2025-26 have reduced taxes on cumulative payouts for salaries over Rs. 600,000 per annum.

Under the outgoing budget for 2024-25, individuals earning over Rs. 600,000 annually were subject to a significantly higher tax structure. For example, income between Rs. 600,00 and Rs. 1,200,000 was taxed at 5 percent. But under the new regime, this rate has been slashed to just 1 percent.

Similarly, those earning between Rs. 1,200,001 and Rs. 2,200,000 were previously taxed Rs. 30,000 plus 15 percent of the amount exceeding Rs. 1,200,000. Under the new rates, this has been reduced to Rs. 6,000 plus 11 percent.

Read More: Rs100 Billion Allocated for Karachi-Chaman Highway in Federal Budget 2025

The following table gives a detailed breakdown of the impact of the rate of income tax on salaried class from July 1, 2025:

Income Tax on Salary – Budget 2025-26

| Per Monthly Salary | Monthly Tax (Existing) | Tax Per Month (After July 2025) | Tax Impact Per Month |

|---|---|---|---|

| PKR 50,000 | ZERO | ZERO | ZERO |

| PKR 60,000 | PKR 500 | PKR 100 | PKR 400 |

| PKR 70,000 | PKR 1,000 | PKR 200 | PKR 800 |

| PKR 80,000 | PKR 1,500 | PKR 300 | PKR 1,200 |

| PKR 90,000 | PKR 2,000 | PKR 400 | PKR 1,600 |

| PKR 100,000 | PKR 2,500 | PKR 500 | PKR 2,000 |

| PKR 110,000 | PKR 4,000 | PKR 1,600 | PKR 2,400 |

| PKR 120,000 | PKR 5,500 | PKR 2,700 | PKR 2,800 |

| PKR 130,000 | PKR 7,000 | PKR 3,800 | PKR 3,200 |

| PKR 140,000 | PKR 8,500 | PKR 4,900 | PKR 3,600 |

| PKR 150,000 | PKR 10,000 | PKR 6,000 | PKR 4,000 |

| PKR 160,000 | PKR 11,500 | PKR 7,100 | PKR 4,400 |

| PKR 170,000 | PKR 13,000 | PKR 8,200 | PKR 4,800 |

| PKR 180,000 | PKR 14,500 | PKR 9,300 | PKR 5,200 |

| PKR 190,000 | PKR 16,666 | PKR 11,200 | PKR 5,466 |

| PKR 200,000 | PKR 19,166 | PKR 13,500 | PKR 5,666 |

| PKR 225,000 | PKR 25,415 | PKR 19,250 | PKR 6,165 |

| PKR 250,000 | PKR 31,666 | PKR 25,000 | PKR 6,666 |

| PKR 275,000 | PKR 38,333 | PKR 31,333 | PKR 7,000 |

| PKR 300,000 | PKR 45,833 | PKR 38,833 | PKR 7,000 |

| PKR 350,000 | PKR 61,250 | PKR 54,250 | PKR 7,000 |

| PKR 400,000 | PKR 78,750 | PKR 71,750 | PKR 7,000 |

| PKR 500,000 | PKR 113,750 | PKR 106,750 | PKR 7,000 |

| PKR 1,000,000 | PKR 288,750 | PKR 281,750 | PKR 7,000 |