Islamabad, June 22 – The Iranian Parliament has passed a bill authorizing the closure of the Strait of Hormuz, the world’s most vital oil transit route. The decision, pending final approval by Iran’s Supreme National Security Council, has already sent shockwaves through global energy markets.

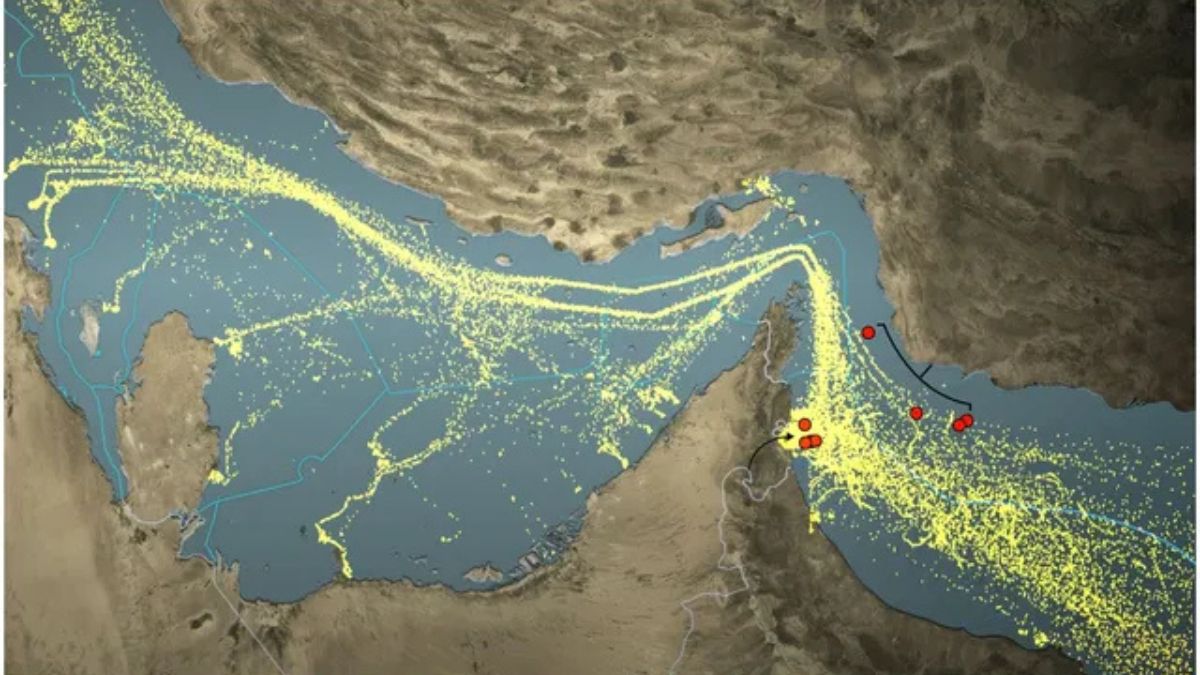

Brent crude jumped to $113.75 per barrel (+6.1%) and WTI crude to $109.80 (+5.8%) following the announcement. The strait handles around 20% of global oil and 25% of LNG exports. A full closure could spike oil prices to $150, experts warn.

Key Global Impacts:

- Global GDP could fall by 0.3% to 1%

- Inflation and supply chain disruptions expected

- Rising manufacturing and transport costs

- Market instability and currency volatility

Pakistan’s Economic Outlook:

Heavily dependent on the strait, Pakistan imports over 70% of its oil through Hormuz. With a FY2025 petroleum import bill above $14.6 billion, Pakistan faces major financial strain.

Read More: Mari Energies Secures Rights to Explore 10 Oil & Gas Blocks

Forecasted Impact on Pakistan:

| Factor | Expected Impact |

|---|---|

| Fuel Prices | Significant increase |

| Inflation | 2–4% rise |

| GDP Growth | Drop by 0.5–1.5% |

| Foreign Reserves | Pressure due to costly imports |

Pakistan’s Ministry of Energy is reviewing emergency supply alternatives via Saudi Arabia and the UAE, and exploring strategic storage measures.

Political Tensions Rise

MP Esmail Kosari, sponsor of the bill, stated, “The Strait of Hormuz is vital to Iran’s sovereignty and national security.” Increased military activity has been reported near the strait, raising concerns of regional escalation.

LNG and fuel futures continue trending higher. International observers are closely monitoring developments amid fears of a broader geopolitical and energy crisis.