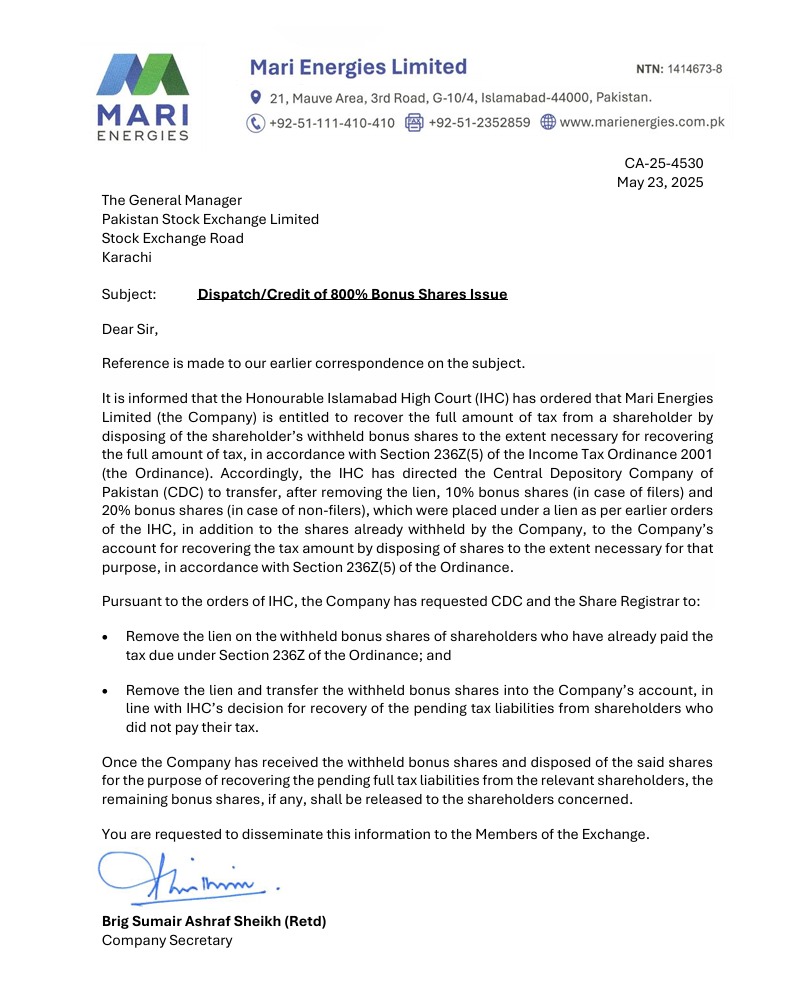

Islamabad, May 23, 2025: Mari Energies Limited has announced the dispatch and credit of an 800% bonus shares issue to its shareholders, following a landmark order by the Honourable Islamabad High Court (IHC).

The court has authorized the company to recover full tax dues by disposing of withheld bonus shares, as per Section 236Z (5) of the Income Tax Ordinance 2001.

According to the IHC directive, the Central Depository Company of Pakistan (CDC) is instructed to remove the lien on certain withheld bonus shares and transfer these shares back to the company’s account.

This includes 10% bonus shares for tax filers and 20% bonus shares for non-filers, in addition to shares already withheld earlier. This step is aimed at recovering pending tax liabilities from shareholders who have not yet fulfilled their tax obligations.

The company has also confirmed that shareholders who have already cleared their tax dues under Section 236Z will have the lien on their withheld bonus shares removed promptly. After tax recovery, any remaining bonus shares will be released to the eligible shareholders.

Read More: Mari Energies Launches “Mari Meal Program” And Second Phase Of “Mari Kissan Dost Program”

Brigadier Sumair Ashraf Sheikh (Retd), Company Secretary of Mari Energies Limited, urged the Pakistan Stock Exchange to disseminate this important update to all members, ensuring transparency and compliance across the market.

Read More: Mari Energies Secures Rights to Explore 10 Oil & Gas Blocks

This move by Mari Energies Limited marks a significant development in corporate governance and tax recovery enforcement, reinforcing the importance of tax compliance for shareholders.