National Bank of Pakistan (PSX: NBP) reported a profit after tax of Rs. 66.33 billion for the nine months ended September 30, 2025, rising 16.5 times from Rs. 4.03 billion in the corresponding period last year. Earnings per share increased to Rs. 30.88 compared to Rs. 1.72 previously.

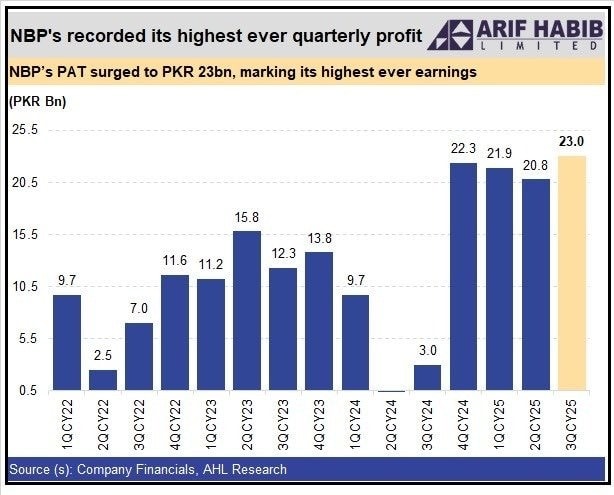

According to brokerage house Arif Habib Limited, the bank reported its highest ever quarterly profit in 3QCY25 of Rs. 23 billion

Despite the strong financial results, the bank did not declare an interim dividend, a decision that surprised market participants who had expected a payout aligned with the bank’s robust profitability.

Mark-up/return/interest earned declined 28 percent year-on-year to Rs. 601.29 billion from Rs. 838.05 billion, while mark-up/return/interest expense fell 44 percent to Rs. 409.94 billion from Rs. 729.61 billion. Consequently, net mark-up/interest income rose 75 percent to Rs. 191.34 billion compared to Rs. 109.44 billion last year.

Fee and commission income increased 27 percent to Rs. 24.8 billion, while dividend income decreased 21 percent to Rs. 3.34 billion. Foreign exchange income slipped 8 percent to Rs. 4.97 billion. Gains on securities climbed 22 percent to Rs. 12.86 billion. Other income rose to Rs. 698.1 million from Rs. 251.8 million. Overall, non-markup/interest income increased 13 percent to Rs. 46.07 billion.

Total income grew 58 percent to Rs. 237.41 billion. Operating expenses increased 11 percent to Rs. 92.07 billion, while total non-markup expenses also rose 11 percent to Rs. 92.12 billion.

READ MORE: PTA, Climate Change Ministry Join Hands to Advance Green ICT

Profit before provisions reached Rs. 145.29 billion, up from Rs. 67.09 billion last year. After provisioning charges of Rs. 2.09 billion, profit before tax surged to Rs. 143.2 billion compared to Rs. 16.19 billion in the same period last year. Taxation increased to Rs. 76.87 billion from Rs. 12.16 billion.

NBP concluded the nine-month period with a net profit of Rs. 66.33 billion, supported by a strong expansion in net interest income, better fee-based earnings, and higher gains on securities, reflecting effective balance sheet management in a changing interest rate environment.