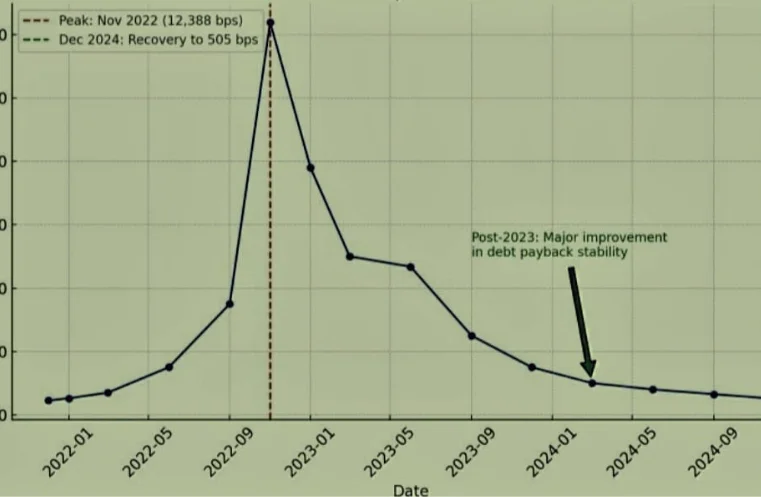

Islamabad, Jan 14: In a significant financial turnaround, Pakistan’s sovereign default risk has dramatically decreased by 93%, with its 5-year Credit Default Swap (CDS) spreads plummeting to 505 basis points in December 2024, down from a staggering peak of 12,388 basis points in November 2022.

This sharp decline signifies a notable recovery in Pakistan’s debt repayment stability, fueled by improved economic conditions, fiscal discipline, and enhanced investor confidence.

Pakistan Default Risk

Khurram Schehzad, the Advisor to the Finance Ministry, emphasized that the drop in CDS spreads has positioned Pakistan ahead of various emerging and frontier markets in terms of risk premiums.

Better debt management, increased foreign reserves, and a disciplined fiscal approach have boosted market confidence in the country’s ability to meet its sovereign obligations.

This positive momentum is also supported by the current global economic conditions, particularly falling interest rates. These developments create an optimal environment for Pakistan to re-enter international capital markets with reduced borrowing costs, potentially easing external financing challenges and boosting the nation’s economic prospects.

Agritech Limited Shares: Public Offer Ends on a High Note

Investor sentiment has also seen a significant boost, with Pakistan’s international bonds rallying as a sign of confidence in the country’s financial stability.

Experts say Pakistan’s successful implementation of the IMF-backed Extended Fund Facility (EFF) reforms directly led to this recovery. These reforms addressed critical fiscal and external challenges.

These efforts, combined with fiscal consolidation, disinflation, and the stabilization of foreign exchange reserves, have significantly reduced concerns about sovereign default.

Despite the positive outlook, experts stress that continued structural reforms are essential for maintaining long-term stability. The latest IMF Article IV report underscores the need to broaden the tax base, manage debt risks effectively, and promote private-sector-led growth to ensure Pakistan’s sustained economic resilience.

With a much-improved credit profile, Pakistan is now in a favorable position to attract foreign investment, which could further accelerate the country’s economic recovery. The drastic reduction in CDS spreads marks a pivotal shift from default risks to renewed access to global markets, heralding a new era for Pakistan’s financial sector.