Islamabad, June 26, 2025: The National Assembly on Thursday passed the Rs17.6 trillion federal budget for the fiscal year 2025-26, incorporating Rs463 billion in new tax measures. The digital economy has been brought under the tax net, yet a significant enforcement measure to ban economic transactions by ineligible persons was largely diluted.

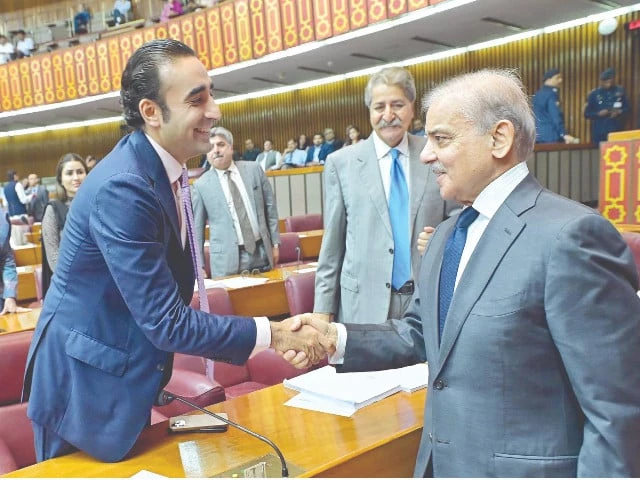

The government of Prime Minister Shehbaz Sharif secured a comfortable majority for the budget’s approval, with 201 votes in favor against 57 from opposition parties, marking Finance Minister Muhammad Aurangzeb’s second budget presentation. Following presidential assent, the Finance Act 2025 is set to come into effect on Tuesday.

The approved budget allocates a substantial Rs8.2 trillion for interest payments, making it the single largest expense. Defense spending follows at Rs2.55 trillion, excluding armed forces development and military pensions. Subsidies account for over Rs1.1 trillion, while pensions and development spending each receive over Rs1 trillion.

Read More: Sindh Assembly Passes Rs3.45 Trillion Budget with Major Tax Relief

An additional Rs917 billion is earmarked for running the civil government. Notably, the income of Beaconhouse National University, Federal Ziauddin University, Punjab Police Welfare Organization, and Army Officers Benevolent Fund and Bereaved Family Scheme will be effectively exempt from tax.

Contracts for the National Logistic Cell (NLC) will face a minimum tax of 3% of gross value, with the normal income tax rate of 29% applicable if the total liability exceeds the collected tax.

Arrest powers for the Federal Board of Revenue (FBR) will remain in law but with added safeguards, a point emphasized by both Pakistan People’s Party (PPP) Chairman Bilawal Bhutto Zardari and Deputy Prime Minister Ishaq Dar.

Chairman FBR Rashid Langrial hailed it as the “best budget any government can give in challenging circumstances. He highlighted principles of deterring fraud and establishing a framework for sales tax registration.

Read More: SCO Fails to Issue Joint Declaration as India Refuses to Sign

To discourage cash use, expenses over Rs 200,000 paid in cash will not be allowed as deductions. The input tax adjustment on certain cash payments will be disallowed. Foreign vendors and digital marketplaces have also been brought under the ambit of tax laws. It includes e-commerce, cash-on-delivery by couriers, and digital streaming services,

The new tax measures totaling Rs463 billion include Rs36 billion introduced after the initial budget presentation on June 12. New levies include a climate support levy of Rs 2.5 per liter on petrol and diesel. A 1% to 3% tax on conventional fuel-based cars to subsidize electric vehicles.

Pensioners with annual incomes exceeding Rs 10 million will now be taxed at 5%. A Federal Excise Duty (FED) of Rs 10 has been imposed on every one-day-old chick. It aims to collect Rs 15 billion annually from an estimated 1.5 billion chicks produced each year. A 10% sales tax on the import of solar panels was also approved.

Despite earlier government claims of collecting Rs389 billion from banning economic transactions by ineligible persons, and warnings of a Rs500 billion mini-budget if the law wasn’t passed, the Prime Minister’s “instructions” led to a softening of these stringent powers.

Read More: Data Vault Launches Pakistan’s First AI-Focused Data Centre in Karachi

The ban on buying residential plots or houses by ineligible persons will now only apply. It is applicable if the property value exceeds Rs50 million, and Rs100 million for commercial properties. Ineligible persons can still purchase cars up to Rs 7 million.

FBR Chairman Rashid Langrial stated that this first step establishes the principle of ineligibility, with limits subject to future revision. Previously, FBR had a low success rate (3.7%) in auditing purchases by ineligible persons due to capacity issues.

The ineligibility condition for cash withdrawals from bank accounts applies if withdrawals exceed Rs100 million per annum. For stock market investments if the cumulative investment exceeds Rs50 million annually. However, ineligible persons cannot maintain savings accounts in banks.

Further tax amendments include an increase in the income tax rate. It applies to income from the debt portion of mutual funds issued to companies, from 25% to 29%. An increase in the income tax rate on profit from government loans, from 15% to 20%.

The National Assembly’s approval of the FBR’s arrest powers in sales tax fraud cases. It came after multiple rounds of negotiations between the PPP and the PML-N. New safeguards ensure no arrests at the inquiry stage, and the accused will have bail rights.

PPP Chairman Bilawal Bhutto Zardari stated his party’s full support for the budget, claiming the government accepted their demands. It includes exempting income tax on salaried individuals earning Rs100,000 and reducing sales tax on solar panels. However, contrary to Bilawal’s claim, the approved bill sets the income tax rate on annual incomes. It is up to Rs1.2 million at 1%, not full exemption.

Bilawal also confirmed the government’s agreement to limit FBR’s arrest powers solely to sales tax forgery, making it a bailable offense. Deputy Prime Minister Ishaq Dar confirmed the addition of new safeguards to address PPP’s concerns. The BISP budget was also increased by 20% to Rs716 billion for the next fiscal year, reportedly at PPP’s demand.