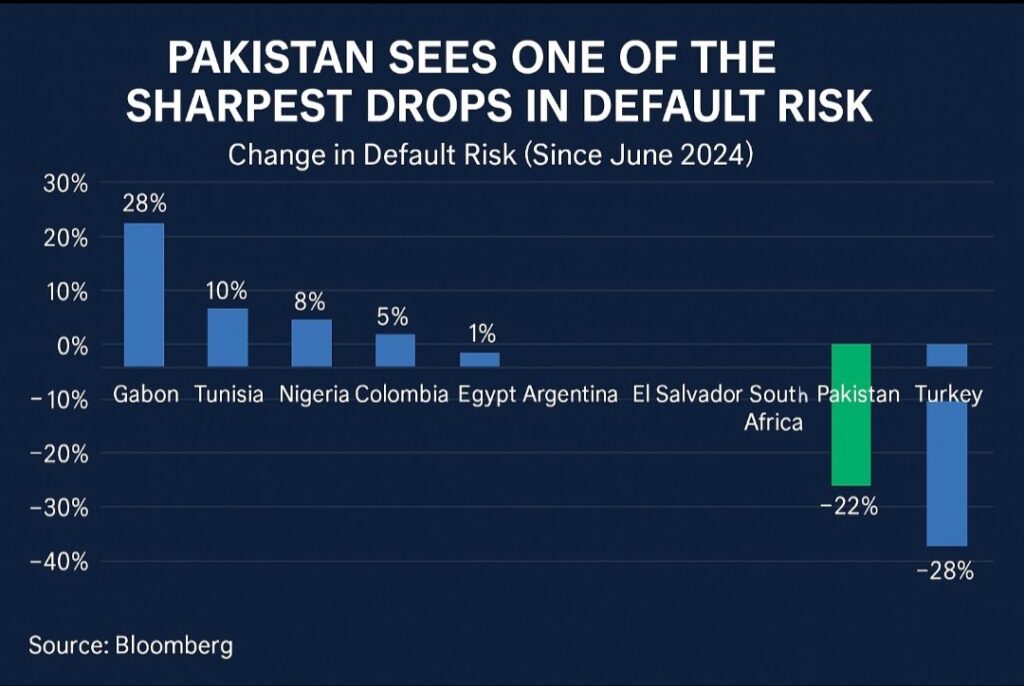

Pakistan has emerged as the world’s second most improved economy in reducing sovereign default risk, according to the latest data compiled by Bloomberg.

In a post on X, Advisor to the Federal Finance Minister, Khurram Schehzad said that the report highlights Pakistan’s remarkable progress in cutting its CDS-implied default probability, reflecting growing investor confidence in the country’s economic outlook.

Bloomberg’s Global Emerging Market (EM) Rankings place Pakistan just behind Turkey in default risk reduction, with one of the sharpest drops recorded globally over the past 15 months, from June 2024 to September 2025. Notably, Pakistan is the only EM country that has shown consistent quarterly improvement throughout this period.

The country’s default probability has plunged by a massive 2,200 basis points, marking the steepest decline among major emerging markets, ahead of South Africa (3%) and El Salvador (2%). In contrast, economies such as Argentina, Egypt, and Nigeria have witnessed a rise in default risks.

READ MORE: IMF Seeks Explanation for $11 Billion Trade Data Gap in Pakistan

Analysts attribute this turnaround to a mix of macroeconomic stabilization, structural reforms, timely debt servicing, and Pakistan’s continued commitment to the IMF program. Additionally, positive ratings actions from international agencies including S&P, Fitch, and Moody’s have reinforced investor confidence.

The sharp decline in sovereign risk underscores Pakistan’s steady rebuilding of market credibility, positioning it as one of the most improved sovereign credit stories in the emerging market universe.