Islamabad, Dec 6: According to the most recent scorecard issued by Fair Finance Asia (FFA), which evaluates how well Asian banks allow customers to actively contribute to sustainability outcomes, Asian banks including those in Pakistan have received low marks on participation and accountability procedures.

In four major areas financial inclusion, consumer protection, financial literacy and education, and participation and accountability mechanisms the new scorecard compared the practices of 15 banks in Cambodia, Indonesia, Pakistan, the Philippines, and Thailand.

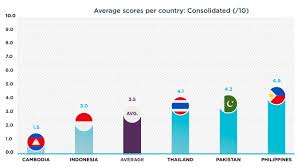

On average, banks performed better in consumer protection (5.5/10) and financial inclusion (5.2/10), but they did badly in engagement and accountability systems (1.3/10). The evaluated banks received an average score of 3.5/10 in each of the four major categories. At the national level, banks with their headquarters in the Philippines have the best performance, with an average aggregated score of 4.9 out of 10. Banks having their headquarters in Pakistan come in second.

Three banks from Pakistan participated in the study: the National Bank of Pakistan (NBP), MCB Bank, and United Bank Limited (UBL). At the national level, banks with their headquarters in the Philippines have the best performance, with an average aggregated score of 4.9 out of 10. Banks having their headquarters in Pakistan come in second.

Pakistani banks received an average score of 6.9/10 for consumer protection and 6.7/10 for financial inclusion. The score dropped to 3.3/10 for financial literacy and education and to 1.2/10 for engagement and accountability.

Pakistani banks frequently promote financial goods with little understanding of how they affect people and society, seemingly putting profit above purpose. Asim Jaffry, Country Program Lead, Fair Finance Pakistan, stated that banks need to do more to empower people and save the environment.

In order to ensure that customers are adequately informed about their sustainability strategies and financing practices and can hold them responsible for fulfilling their commitments, FFA, along with national coalitions Fair Finance Cambodia, ResponsiBank Indonesia, Fair Finance Pakistan, Fair Finance Philippines, and Fair Finance Thailand, as well as research partner Profundo, has urged banks to strike a balance between inclusion goals and financial literacy and consumer empowerment initiatives.

![PMDC Withdraws Strict Exam and Attendance Rules PMDC MDCAT Answer Key 26 October 2025 Download PDF [ Link Out ]](https://bloompakistan.com/wp-content/uploads/2025/10/PMDC-MDCAT-Answer-Key-26-October-2025-Download-PDF-Link-Out--300x169.webp)