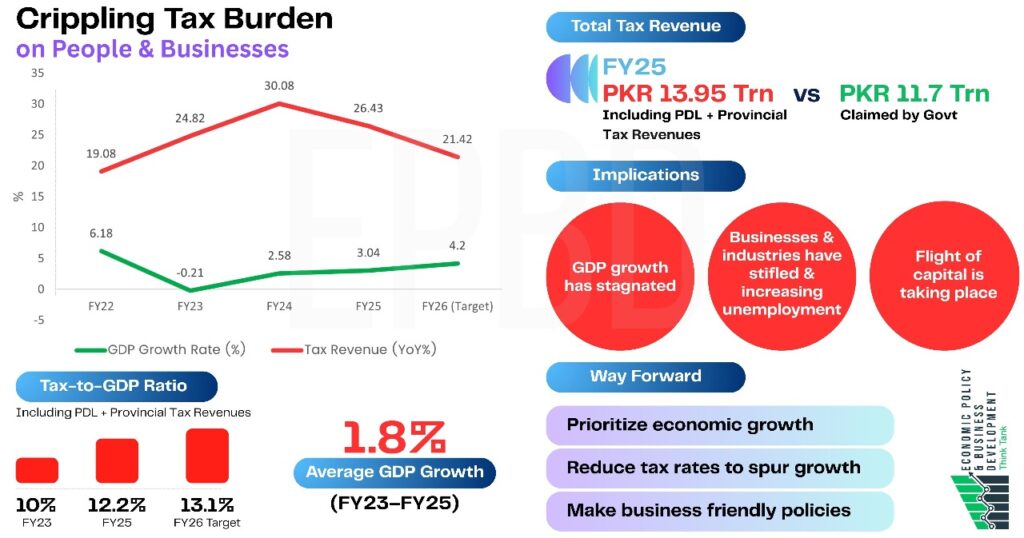

A new report titled “Crippling Tax Burden” by the Economic Policy and Business Development Think Tank warns that Pakistan’s tax burden on businesses and salaried individuals has reached unsustainable levels, outpacing the country’s economic growth and threatening long-term stability.

According to the report, Pakistan’s tax collection has increased by 105% since FY22, rising from Rs. 6.8 trillion to Rs. 13.95 trillion in FY25, while the economy grew by just 1.8% on average. For FY26, the government has set an ambitious Rs. 16.94 trillion target, an increase of over 21% from last year.

The report noted that tax revenue from the business sector rose from Rs. 2.2 trillion in FY22 to Rs. 5.3 trillion in FY25, marking a 131% jump, while the salaried class saw a 206% increase in their tax payments during the same period. Experts warn that this rising tax burden in Pakistan is discouraging investment, formalisation, and business expansion.

The think tank criticised the government’s focus on “missed revenue targets,” saying it diverts attention from the real issue, excessive extraction from compliant taxpayers. The report also found that Pakistan’s actual Tax-to-GDP ratio is closer to 12.2%, not the officially reported 10%, when all levies such as the Petroleum Development Levy are included.

READ MORE: Govt Announces Major Privatisation Drive to Boost Economy

The report recommended shifting from revenue extraction to economic stimulation, broadening the tax base to include untaxed sectors, and reducing the burden on compliant taxpayers. It also urged greater transparency in reporting tax data and realistic target-setting aligned with economic realities.