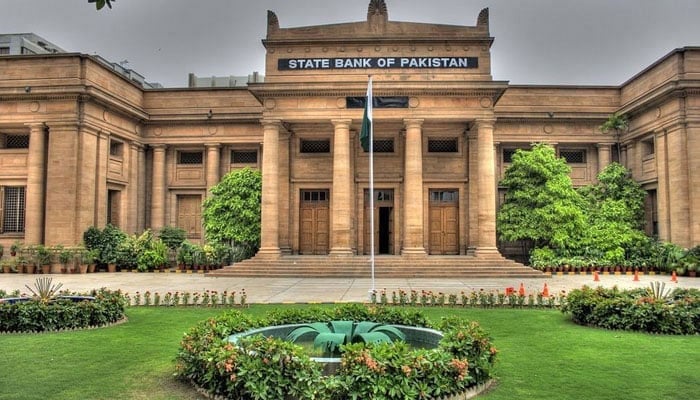

Islamabad, Mar 21, 2025: The State Bank of Pakistan (SBP) has taken another step toward enhancing digital financial services by granting in-principal approval to Paysa Technologies, a promising fintech operator.

With this approval, Paysa Technologies has secured an Electronic Money Institution (EMI) license, allowing it to introduce a range of digital payment solutions.

These include e-money wallets for consumers and businesses, as well as POS and QR payment services, further driving Pakistan’s shift toward a cashless economy.

Founded in 2022, Paysa Technologies aims to simplify online transactions for individuals and businesses, offering secure and efficient financial solutions.

The company is now set to join Pakistan’s expanding digital finance ecosystem, catering to the growing demand for seamless and secure payment options.

Read More:

SECP Empowers Life Insurers with New Flexibility

At present, Pakistan’s fintech landscape comprises multiple EMI operators at various stages of regulatory approval.

Four operators, including Paysa, have received in-principal approval, while one has advanced to the pilot operations stage.

Additionally, six operators are fully operational, providing commercial services, whereas four have withdrawn their licenses.

As Pakistan continues its journey toward financial inclusion, the approval of new fintech players like Paysa marks a significant step in strengthening the country’s digital payment infrastructure.