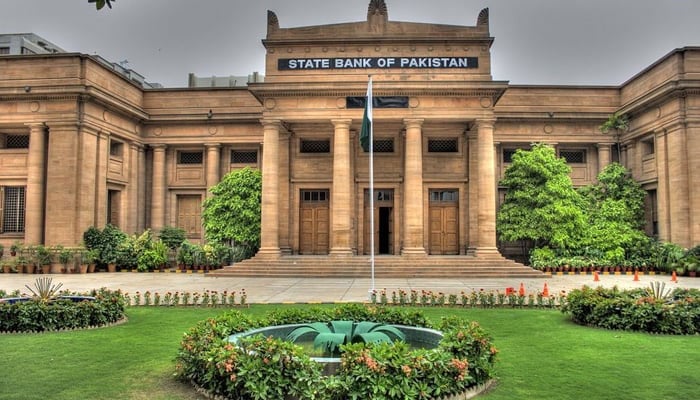

Islamabad, JULY26: The State Bank’s foreign exchange reserves dropped sharply by $397 million in the week that concluded on July 19, making it challenging for the government to maintain the reserves at roughly $9 billion prior to entering into a new loan arrangement with the IMF.

The State Bank claims that the fall in reserves to $9.027.2 billion was caused by repayments of external loans. The nation is having a difficult time paying down its massive external and domestic debt.

Since they have already exhausted the majority of the available sources of funding, economic management are facing challenges in meeting the $24 billion requirement for foreign debt servicing in FY25.

Currently, Chinese investors and Finance Minister Muhammad Aurangzeb are discussing a loan rescheduling. The Chinese government has already received a letter from the prime minister for review. The ministry of finance is working to reschedule a $15 billion energy loan. Financial industry insiders claimed that Chinese businesses were offended by media stories that blamed them for IPP-related issues.

Concern has also been expressed by the Chinese over the $1.8 billion in profits that have not yet been paid. According to sources, Mr. Aurangzeb would have to bring up concerns over China’s debt, which is presently valued at Rs. 500 billion, in the energy sector.China has invested $21 billion in 21 energy projects in Pakistan.

Pakistan is requesting that the 10-year debt repayment period be extended to 15 years. This would lessen the $700 million estimated foreign exchange outflow.Experts in the financial sector and certain commentators think that the country’s future depends on the Chinese energy loan being rescheduled. They think that before finalizing the $7 billion deal for Pakistan, the IMF is willing to reschedule the Chinese loan.

Pakistan would not be able to arrange $24 billion for debt servicing in FY25 without rescheduling. While prospects for bilateral loans are dim, the government is still unable to access the global bond market in order to issue bonds and raise money.

China rescheduled some payments in FY24, and Saudi Arabia and the United Arab Emirates have already deposited billions of dollars with the State Bank. The central bank’s reserves fell by $397 million, which currency analysts said would depress the value of the currency. They feared that more outflows would have an impact on the stable exchange rate.$14.335 billion in liquid foreign reserves as of July 19 included $5.308 billion held by commercial banks.