KARACHI: The stock market maintained its record-breaking run-on Tuesday, pushing the index to a new intraday high above 81,000 as confidence about quickly achieving a Staff-Level Agreement with the International Monetary Fund (IMF) grew.

According to Arif Habib Corporation’s Ahsan Mehanti, uncertainty around PSX’s results season caused equities to end at an all-time high. With hopes for large dividend payments, certain energy and financial scrips led this.

The government’s discussions on privatizing failing state-owned businesses and market hopes for a resolution to the $15 billion China energy debt restructure ahead of the IMF’s new rescue accord, he said, contributed to the positive close.

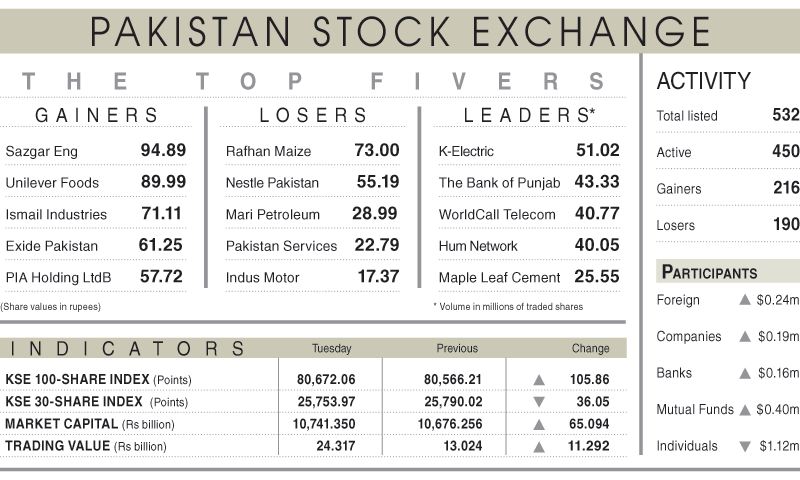

The equities market, according to Topline Securities Ltd., showed a mixed trend. The index saw a little rise of 106 points, or 0.13 percent, as it climbed to an intraday high of 81,087 points before leveling down at 80,672 points.

Companies such as FFC, POL, ILP, Engro FertFERT, and FFBL, with a combined score of 183 points, contributed to the positive momentum of the market, which was led by the textile, fertilizer, and exploration and production (E&P) sectors.

At 610.26 million shares, the entire trading volume more than doubled. Day-over-day, the traded value increased by 86.69 percent to Rs24.64 billion.

Stocks such as K-Electric (51.02 million shares), The Bank of Punjab (43.33 million shares), World Call Telecom (40.77 million shares), Hum Network (40.05 million shares), and Maple Leaf Cement (25.55 million shares) were among the top contributors to the traded volume.

Sangar Engineering Works Ltd (Rs94.89), Unilever Foods (Rs89.99), Ismail Industries (Rs71.11), Exide Pakistan (Rs61.25), and PIA Holding (B) (Rs57.72) were the shares showing the biggest rises in their share prices in absolute terms.

The firms that had notable declines in their share prices in absolute terms were Nestle Pakistan (Rs55.19), Rafhan Maize (Rs73.00), and Pakistan Services (Rs22.79), Indus Motor (Rs17.37), and Mari Petroleum (Rs28.99) . Foreign investors bought $0.24 million worth of shares, turning them into net purchasers.