Islamabad, 12 June 2025: Pi Network Price has shown resilience despite persistent downward pressure in recent days, maintaining a foothold above its $0.60 support threshold.

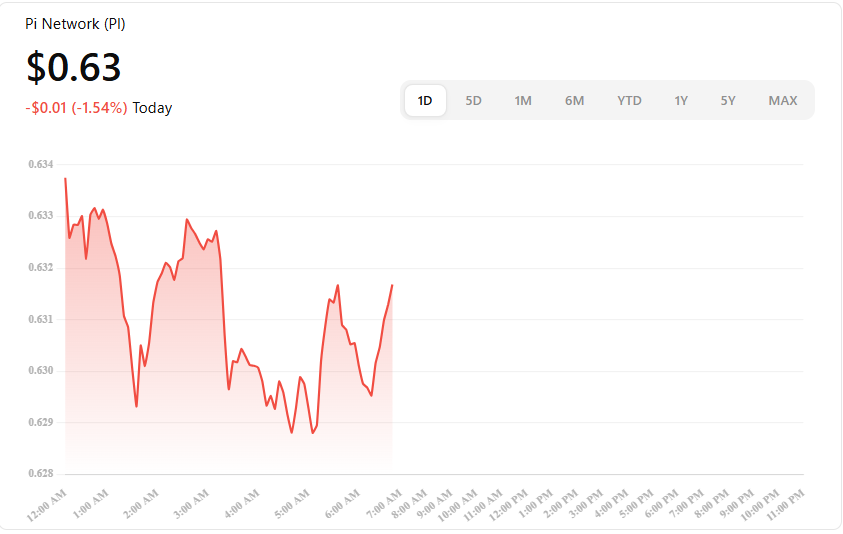

Over the last two weeks, the digital asset has been consolidating near the $0.63 level, signaling early signs of a potential market reversal.

Technical indicators are beginning to suggest that momentum could be shifting. According to the MACD (Moving Average Convergence Divergence) analysis, the Pi Network Price is approaching a bullish crossover. This technical development typically indicates a possible end to bearish sentiment and the start of upward price action.

Here’s the current Pi Network (PI) price and trends:

Bullish Indicators

- MACD Turning Positive: Multiple sources indicate the MACD is nearing a bullish crossover, which often marks the end of a bearish period and the start of upward momentum.

- Triple-Bottom & Falling-Wedge Patterns: Several analysts spot a stable triple-bottom and falling-wedge chart structure a classic bullish reversal setup. Peak targets range from ~$0.86 up to $1.67, with long shots toward ~$2.74 if strong breakout occurs.

Bearish/Pause Signals

- Key Support in Danger: Pi is holding around $0.61–$0.62. A breakdown below this zone could lead to drops toward $0.55–$0.57

- Ongoing Selling Pressure: Token unlocks in June (~246 M tokens) and bearish indicators like Ichimoku cloud and EMA alignments suggest downside risk remains prominent

- Weak Technicals on Short Term: Daily technical ratings are still largely bearish or neutral—14 sell signals vs. only 2 buy signals .

Short-Term Outlook

| Level | Bullish Scenario | Bearish Scenario |

|---|---|---|

| Support | Holds ~$0.61–$0.64 – signals base for rebound. | Breaks below ~$0.60–$0.62 – risk to ~$0.55 or lower. |

| Resistance 1 | Break above ~$0.71–$0.75 – confirms bullish setup. | Gets rejected – further downward pressure likely. |

| Resistance 2 | Breakout past ~$0.86–$1.00 – could ignite rally toward $1.50–$2.70. | Remains clogged – stagnation or gradual downtrend. |

Analysts suggest that if this momentum holds, it could foster increased confidence among market participants. Such sentiment may result in renewed buying interest, potentially driving the asset’s value higher in the near term.

Additionally, external macroeconomic developments may offer supportive conditions. Recent progress in trade relations between the US and China, including a renewed commitment to diplomatic frameworks, may provide a more favorable backdrop for risk assets like cryptocurrencies including Pi Network’s native token.

One of the more contentious topics within the Pi community remains the platform’s unique dual-value structure.

READ MORE: Rawalpindi Opens Incomplete Flyover

The model distinguishes between a “Global Consensus Value” (GCV), reportedly set at $314,159, and the live exchange rate, which recently hovered around $0.64.

This wide divergence has fueled ongoing debate among Pi users, especially after the token’s sharp decline an 80% drop from its previous highs raising questions about transparency and valuation credibility.

Community frustration has also grown due to unresolved issues, including delays in token migration and allegations of unfulfilled rewards.

Despite the controversies, the asset has managed to hold firm above $0.61 for two consecutive weeks. While no major rebound has taken place yet, its price stability has caught the attention of technical analysts who point to potential resistance around the $0.71 mark.

Crypto strategist Tom Camp recently highlighted a breakout above a key trendline on the four-hour chart, stating that the extended consolidation may be setting the stage for a meaningful rally.

According to Camp, Pi’s prolonged sideways movement “could be the calm before the storm,” hinting at a possible surge to $1.50 if momentum continues to build.

READ MORE: Surplus Electricity for Crypto Mining; Govt Pondering

Though it remains speculative, optimism persists among supporters who believe the token could regain strength, particularly if market conditions turn favorable.

In summary, Pi Network Price continues to defend critical support levels, drawing cautious optimism from analysts who see technical and macro signals aligning for a potential price recovery.