Islamabad, Oct 1: Tax season can be overwhelming, but the Integrated Revenue Information System (IRIS) makes filing your taxes a simple process. Here’s a step-by-step guide to using IRIS for easy tax filing, ensuring compliance and maximizing your refunds.

Step 1: Register on IRIS

To start filing your taxes with IRIS, you first need to register on the platform. Visit the official website and click on the registration link. Enter the required information, including your CNIC number, mobile number, and email address. After your account is set up, you’ll receive a confirmation message that allows you to log in and begin using the system.

Step 2: Gather Necessary Documents

Collect all essential documents to file your taxes accurately. This includes income statements, bank statements, and receipts for any deductible expenses. Having these documents ready will streamline the process and help ensure you don’t overlook any important details while completing your tax return.

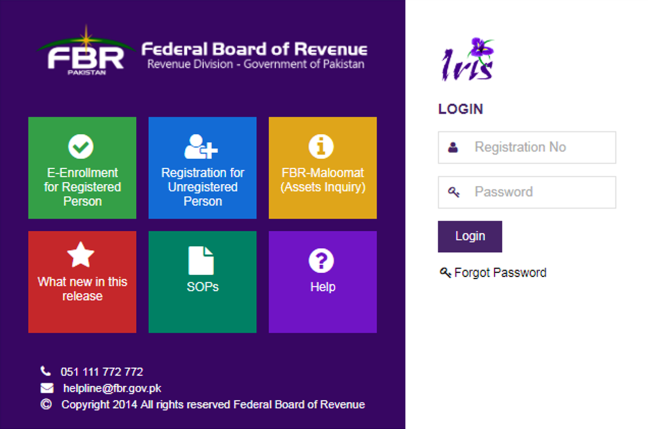

Step 3: Log into IRIS

Once you have your documents ready, log into your IRIS account. The user-friendly interface makes it easy to navigate through different sections. Take some time to explore the dashboard, where you can find links to file your income tax return, check your status, and access various helpful tools.

Step 4: Fill Out Your Tax Return

Select the option to file your income tax return. IRIS will guide you through each step, prompting you to enter your personal details, income sources, and deductible expenses. Be sure to double-check your entries for accuracy, as mistakes can lead to processing delays or penalties.

Step 5: Review and Submit

After completing your tax return, review all the information you’ve provided. IRIS offers a summary of your return to help you spot any errors. Once you’re sure everything is correct, submit your return electronically. You’ll receive a confirmation of submission, which you should save for your records.

Step 6: Track Your Application

After submission, you can track the status of your application through your IRIS dashboard. The system keeps you updated on the processing stages, ensuring you stay informed. If the Federal Board of Revenue (FBR) requires any additional information, you’ll receive notifications via the platform.

In conclusion, using IRIS for tax filing simplifies the often-daunting preparation process. By following this step-by-step approach, you can file your taxes confidently and efficiently, allowing you to focus on other important aspects of your life. Embrace technology and make tax filing effortless with IRIS.