KARACHI: According to a report released by the central bank on Tuesday, the country received over $30 billion in remittances in FY24, representing a 10.7% rise over the previous fiscal year. Inflows for the previous month also increased by 44% year over year.

Although the country’s receipts for FY22 were less than the record $31.3 billion, they were still about $3 billion greater than those for FY21. Remittance growth has already outpaced export revenue growth, indicating the growing reliance of the economy on Pakistanis living abroad.

The State Bank reports that remittances totaled $30.3 billion in FY24 as opposed to $27.3 billion in FY23. According to financial analysts, the rise is satisfying for the government since it comes after another positive report indicating that, in the first 11 months of FY24 (July 2023 to May 2024), the current account deficit had dropped to just $464 million.

But they issued a warning, pointing out that the economy’s increasing reliance on remittances can have severe consequences, particularly if exports begin to decline.

Exporters have been yelling against the budget’s planned additional taxes and the unrelenting rise in electricity prices, since these two threats have rendered operating costs in the global market uncompetitive.

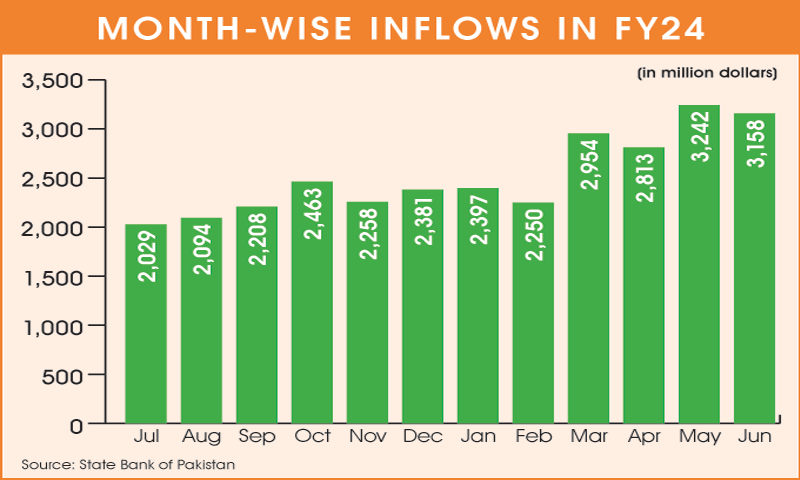

In order to obtain IMF financing, the country will have to “swallow more bitter pills,” according to Prime Minister Shehbaz Sharif on Monday. According to SBP figures, inflows last month were $3.2 billion, up 44.4% from $2.187 billion in June of FY23.Pakistan received $3.242 billion in May of FY24. Due to a significant increase in inflows, the second half of FY24 performed far better than the first.

Increased inflows are interpreted by the financial industry as a sign of optimism for the economy, namely for the stability of the currency rate, which has been steady for over four months.

When compared to the previous fiscal year, FY23, the inflows from nearly all key destinations showed improvement and a large rise.

With $7.424 billion in inflows, Saudi Arabia accounted for the largest portion, growing 13.6% in FY24. This contrasted with a 15.8% decrease in FY23. Pakistan experienced the worst fiscal year, FY23, losing over $4 billion in remittances over the year before.

The United Arab Emirates saw the second-highest inflows, increasing by 18.9% to $5.534 billion. The UAE’s remittances showed a net decrease of 20.4% in FY23.

The United States and the United Kingdom had an increase in inflows of around 11%, totaling $3.531 billion and $4.521 billion, respectively.

With inflows of $3.18 billion and $3.53 billion, respectively, the GCC and EU nations’ receipts saw positive growth of 0.6% and 12.7%, respectively. With $978 million in remittances, Italy outperformed the FY23 average by 16.5%.

Remittances are expected to increase in the upcoming years due to the large number of Pakistanis who are leaving the nation in search of employment, according to some analysts.