Islamabad: The Khyber Pakhtunkhwa (KP) government has formally requested income tax exemptions for its hydropower projects, seeking parity with the private sector and projects in Azad Jammu and Kashmir (AJ&K).

In a letter addressed to the Federal Finance Minister, Senator Muhammad Aurangzeb, Brig. (Retd.) Tariq Saddozai, Special Assistant to the Chief Minister on Energy and Power, emphasized the province’s significant hydroelectric potential.

He argued that if this resource is harnessed through a systematic, transparent, and well-planned approach, it could play a critical role in ensuring long-term, sustainable energy security for the country.

The KP government highlighted that both federal and provincial administrations are striving to make the most of the affordable, indigenous hydro resources to improve the national economy.

It stated that hydropower projects constructed by the provincial government using its own financial resources are not only contributing to the country’s energy supply but also bolstering economic development, given that sustainable economic activity hinges on the availability of reliable and cost-effective electricity.

The provincial authorities pointed out that profits from hydroelectric generation are currently exempt from income tax under the Income Tax Ordinance 2001.

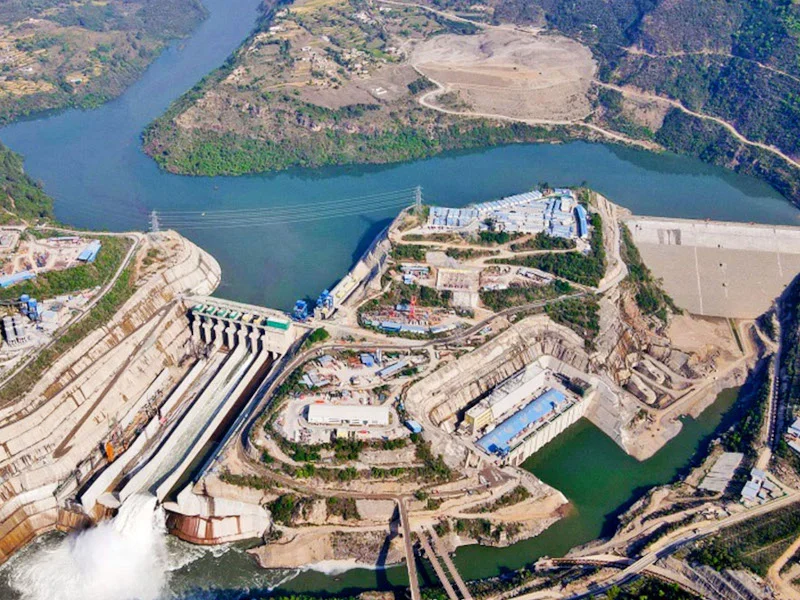

Wapda

These exemptions are granted to private entities under Clause 132 of Part I of the Second Schedule and to WAPDA through entry No. (x) of Clause 66 of the same schedule.

According to Saddozai, the exemption is also extended to companies registered in Pakistan or AJ&K that own and operate hydropower projects situated in those regions, via a proviso under Clause 132.

However, despite fulfilling similar criteria, the projects initiated by the Pakhtunkhwa Energy Development Organization (PEDO) have not been granted such exemptions, resulting in what the KP government sees as discriminatory treatment.

PEDO has been claiming income tax exemption under the relevant proviso of Clause 132, yet has not been recognized accordingly by the tax authorities.

To address this issue, the KP government has proposed specific amendments to the Income Tax Ordinance 2001.

Power Generation

Firstly, it recommends that Clause 66 of Part I of the Second Schedule be amended by inserting a new entry after sub-clause (xvii), explicitly naming PEDO and companies established by the KP government for power generation purposes as exempt entities.

Read More: 4th International Hydropower Conference Scheduled for January 9

Secondly, the province suggests amending Clause 11A of Part IV of the Second Schedule by adding similar entries to provide relief from withholding taxes.

These entries would formally recognize PEDO and KP-government-formed companies involved in power generation as eligible for exemptions since their inception under the Pakhtunkhwa Energy Development Organization Act, 1993, as revised in 2020.

The KP government has invoked Section 53 of the Income Tax Ordinance 2001, which outlines exemptions and concessions included in the Second Schedule.

It has requested that the Finance Division incorporate these proposed changes and submit them for consideration in the Finance Bill for the fiscal year 2025-26, during the National Assembly’s budget session.

The letter to the Finance Minister concludes by urging the federal government to instruct relevant authorities to initiate these amendments.

Also Read: KP Launches Digital Internship Program for Graduates

It stresses that such legislative changes would enable the province to further develop its hydropower resources, contributing to both economic resilience and energy self-sufficiency. Story by Ahmed Mukhtar.